Learn to Profit From Short Selling

Crypto market has been choppy lately. Up and Down. Some assets are still in a solid Uptrend (see here) but many have inflected to Downtrend. Is it good time for Short Selling?

Traders can make money in both directions:

1. Buy assets in Uptrend

2. Short Sell assets in Downtrend

Keep It Simple Stupid (KISS): trade with the trend, trend is your friend.

Here’s an example of a Short Sell trade in NEO (Neo) that is featured among our trade setups in Technical Analysis section:

Example of Short Selling: NEO (Neo)

Once price broke below its 200-day Moving Average and below $12.00 support, that was a clear signal that trend reversed to Down. Price bounced up to that critical level and was rejected again. Short Sell trade setup is now 14% in the money! This is no rocket science. Just the basics: Trend + Support and Resistance.

How To Find More Trading Opportunities?

You can easily find assets where price has broken below 200-day Moving Average in the last 5 days using our Crypto Screener. Here’s a quick filter (see live results).

Assets Breaking 200-Day MA

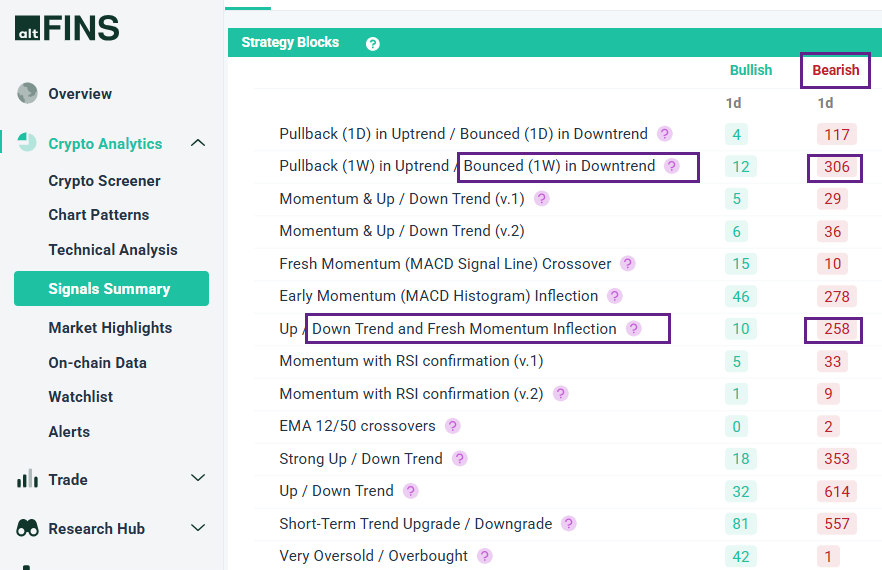

Alternatively, you can search for assets where price is in a Downtrend but has bounced up, which provides an opportunity to Short Sell as it approaches resistance (ofter 200-day moving average). Here’s a quick filter (see live results).

Assets in Downtrend & Approaching 200-Day MA Resistance

Short Sellling Example: TWT (Trust Wallet Token)

TWT (Trust Wallet Token) is an example of ”Bounced in Downtrend” trade signals for Short Selling.

It’s in a Downtrend, based on altFINS trend ratings, but has bounced back up to $1.00 resistance and 200-day Moving Average (200 SMA) resistance zone. It’s likely to get rejected here and resume its downtrend back to $0.80 for a 20% profit potential.

Get similar signals in our VIP channel. Learn to trade for profit with altFINS!

We teach 7 trend and swing trading strategies, as well as Short Selling, Marging Trading and Risk Management techniques in our new Crypto Trading Course.

0 Comments

Leave a comment