How to Survive in Crypto Trading

The world of cryptocurrency trading is dynamic and often unpredictable. The recent market correction has reminded us that the key to profitable trading lies in effective risk management and maintaining longevity in the market. It’s essential to stay in the game long enough to benefit from up cycles and bull runs. If you incur massive losses that deplete your portfolio, recovery becomes almost impossible.

This guide, based on Lesson 9 of our new Crypto Trading Course, outlines crucial strategies for managing risk and thriving in the volatile crypto markets.

Essential Risk Management Strategies

1. Stop Loss Orders

Stop Loss orders are crucial for preventing major losses. They automatically sell your asset when the price drops to a predetermined level, helping you avoid further losses. Our free e-book provides an in-depth guide on using Stop Loss orders effectively.

2. Position Sizing

Never risk more than 2% of your portfolio on a single trade. This approach limits your exposure and potential losses, ensuring that a single bad trade won’t wipe out your investment.

3. Avoid Leverage

Using leverage can amplify both gains and losses. To avoid the risk of substantial losses, it’s advisable to trade without leverage, especially if you’re a beginner.

4. Reward to Risk Ratio (RRR)

Aim for a Reward to Risk Ratio (RRR) of at least 2:1. This means that your potential profit should be at least twice the amount you risk. This strategy ensures that your winning trades more than compensate for any losses.

5. Emotional Discipline

Emotional discipline is key to successful trading. Have a well-defined trading plan and stick to it. Avoid making impulsive decisions based on market fluctuations or emotional reactions.

6. Hedging with Short Sells (Optional)

Consider having a few short positions to hedge against market downturns. This strategy can provide some protection for your portfolio during bear markets.

Setting Stop Loss Levels

Using Stop Loss orders effectively is essential to prevent major losses. In Video 4 of Lesson 9, we explain three approaches to setting appropriate Stop Loss levels:

- Below Prior Swing Low: Place a Stop Loss order just below the most recent swing low to safeguard against significant downtrends.

- Below Key Level: Position your Stop Loss below the nearest key level, such as a support line, to minimize potential losses.

- Using RRR: Determine your Stop Loss level based on a Reward-Risk-Ratio (RRR) of 2:1 to ensure balanced risk management.

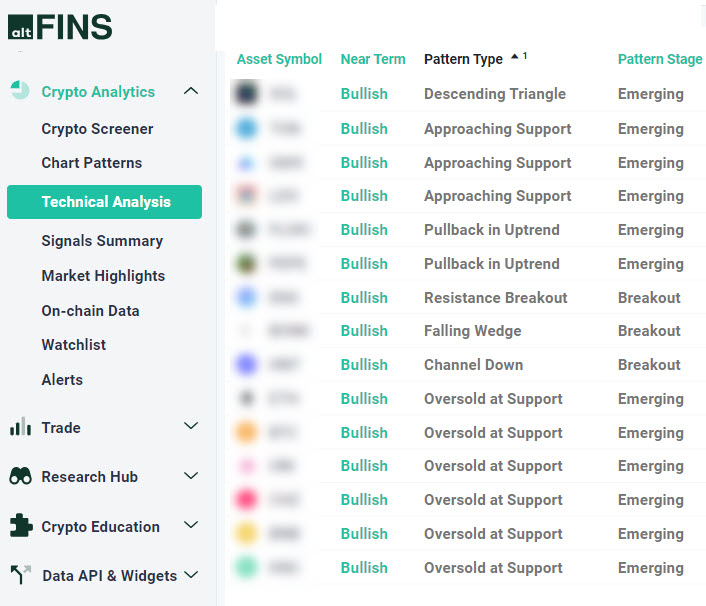

For more detailed explanations, download our free e-book. Additionally, check our Technical Analysis section for Stop Loss levels in our trade setups, especially our “Hot” trades.

0 Comments

Leave a comment