Falling Wedge Breakouts: Seize the Opportunity!

As alerted in our members’ group (read blog), we are witnessing breakouts from Falling Wedge and Channel Down patterns. Even in the current downmarket, these patterns can lead to substantial gains.

XRP (Ripple) Example:

Source: altFINS

XRP surged +20% higher after breaking out from a Falling Wedge pattern. This is a testament to the potential of such setups:

Potential Big Moves Ahead

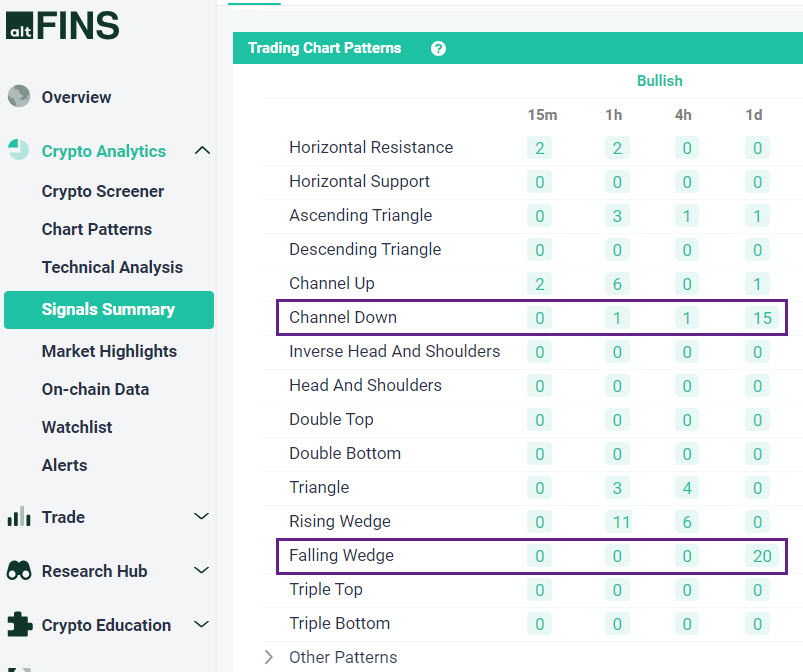

Our historical data highlights the success rates:

- Channel Down breakouts: 73%

- Falling Wedge breakouts: 64%

Upcoming Breakouts:

APE (ApeCoin): If APE breaks out of the Falling Wedge pattern above the $0.80 resistance, it could rally by +25% to $1.00.

Source: altFINS

Stay Prepared:

To capitalize on these bullish breakouts, set up alerts and use the altFINS mobile app for timely trading opportunities. Setting up price alerts is easy – here’s how:

Where to Find These Patterns:

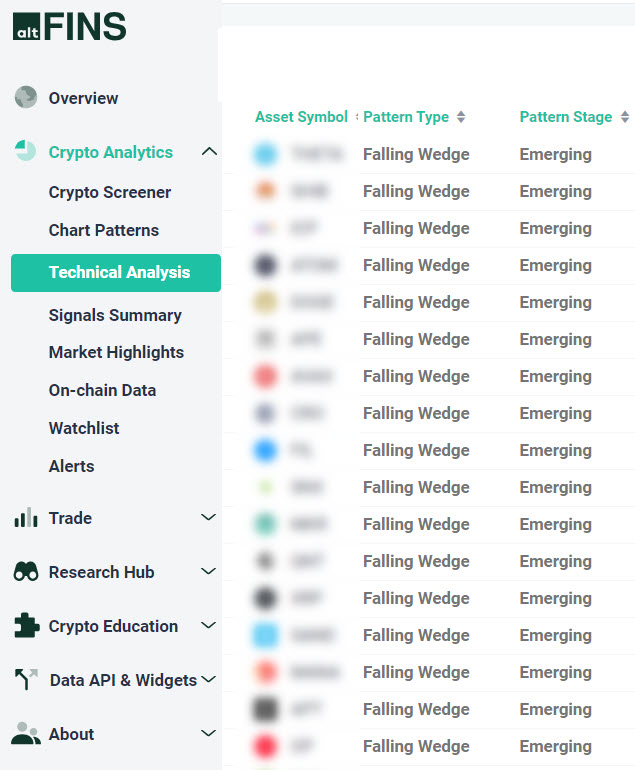

You can find assets in Falling Wedge and Channel Down patterns on the altFINS platform in three sections:

- Chart Patterns: Search for Channel Down and Falling Wedge types.

- Technical Analysis: Detailed trade setups for 65 major altcoins.

- Signals Summary: Under the Patterns section.

Example – Signals Summary:

Source: altFINS

Expert Tip:

Never miss another trading signal. Create alerts for any chart pattern and receive notifications directly on your phone. Here’s a quick guide on setting up alerts

Trade Setups:

Our trade setups include Take Profit and Stop Loss levels for effective risk management. Don’t miss these potentially big gainers on breakouts.

Understanding the Patterns:

Falling Wedge and Channel Down patterns are common trend reversal patterns. Emerging in a downtrend with lower highs and lower lows, they signal that the selling pressure is neutralized, and value buyers are entering the market. This often leads to a breakout followed by rapid price movements (i.e., profits).

Explore these setups in our Technical Analysis section and stay ahead of the market.

Source: altFINS

Don’t miss out on the next big breakout!

0 Comments

Leave a comment