ETH Spot ETF is approved

Ten ETH Spot ETFs have been given the final approval to begin trading today. Will we see a “sell on news” correction like we saw with many other similar events?

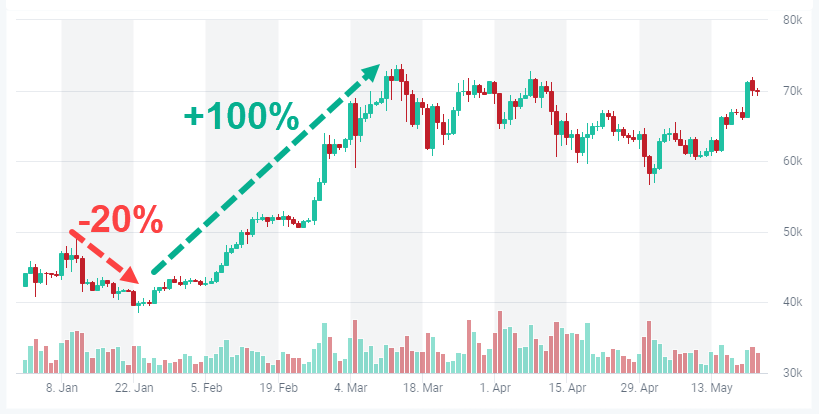

Recall that BTC declined 20% after BTC Spot ETFs were launched, then rallied 100%…

BTC price after Spot ETF launch

Source: altFINS

However, we don’t believe ETH will decline 20%. That’s because that “sell the news” pullback had already occurred in the last two months!

Recall that ETH ran up 25% on May 18th after a surprise announcement that ETH Spot ETFs will be launched (see TA chart below).

We warned our VIP members that this big gap was going to get filled. Meaning, the ETH price would retrace back from $3,900 to $3,200.

And it did just that:

ETH Technical Analysis

Source: altFINS

You can find this and 65 other trade setups in our Technical Analysis section so you’re always on top of the latest price action and save time looking for trading ideas.

So what we may see with Ethereum (ETH) price is a shallow pullback to support area of $3,200 and 200-day moving average.

This would be a great swing trade entry opportunity in Uptrend with +20% potential upside to $4,000 thereafter.

We teach “Pullback in Uptrend” trading strategy in Lesson 4 of our free Crypto Trading Education course, which includes 10 lessons, 40 videos, quizzes and notes, covering 7 trading strategies that will help you profit in any market conditions.

New ATH for ETH by year end?

Bitwise has predicted that this event will drive Ether’s price to new all-time highs above $7,000 (prior ATH is $4,900).

If this happens, altcoins will go nuts!!

Read which projects will benefit from ETH Spot ETF in this report!

This optimistic forecast is supported by the expectation of substantial inflows into 10 Spot ETFs, with estimates suggesting they could attract up to $15 billion within the first 18 months alone.

One key reason for this volume of inflows is the current 0% short-term inflation rate for ETH, compared to Bitcoin’s 1.7% when its spot ETFs were launched.

Additionally, a significant portion of ETH (28%) is staked and thus off the market, which limits supply and can drive up prices.

Unlike Bitcoin miners who need to sell their holdings to cover operational costs, ETH stakers have no such necessity, creating a more favorable market dynamic for price appreciation.

0 Comments

Leave a comment