EMA crossover Trading Strategy tutorial

As the old adage in trading goes: trend is your friend, trade with the trend!

Trend traders are obsessed with identifying an Uptrend early and riding it for big gains!

altFINS makes trend spotting easy. Our platform constantly measures trends and trend changes for nearly 3,000 assets.

Traders often use moving average crossovers for trend spotting and trade entry and exit. That’s because moving averages smooth out the day-to-day volatility in price changes and captures the overall trend instead.

This is a simple yet powerful trend trading strategy. Find a trend and ride it for big gains.

In February, Toncoin (TON) had a bullish crossover (EMA 12 above EMA 50) and that lead to a +250% gain!!

TON (Toncoin): EMA 12 Cross Above EMA 50

One such strategy involves using EMA 12 and EMA 50 crossovers.

We teach this trading strategy in Lesson 2 of our new Crypto Trading Course, which includes 10 lessons covering 7 trading strategies, margin trading, short selling and risk management.

EMA, or Exponential Moving Average, is a moving average that places greater emphasis on more recent price values. That makes EMA more responsive to recent price changes.

Bullish Exponential Moving Average (EMA) crossover occurs when a short-term EMA (e.g. 12 day) crosses above the long-term EMA (e.g. 50 day).

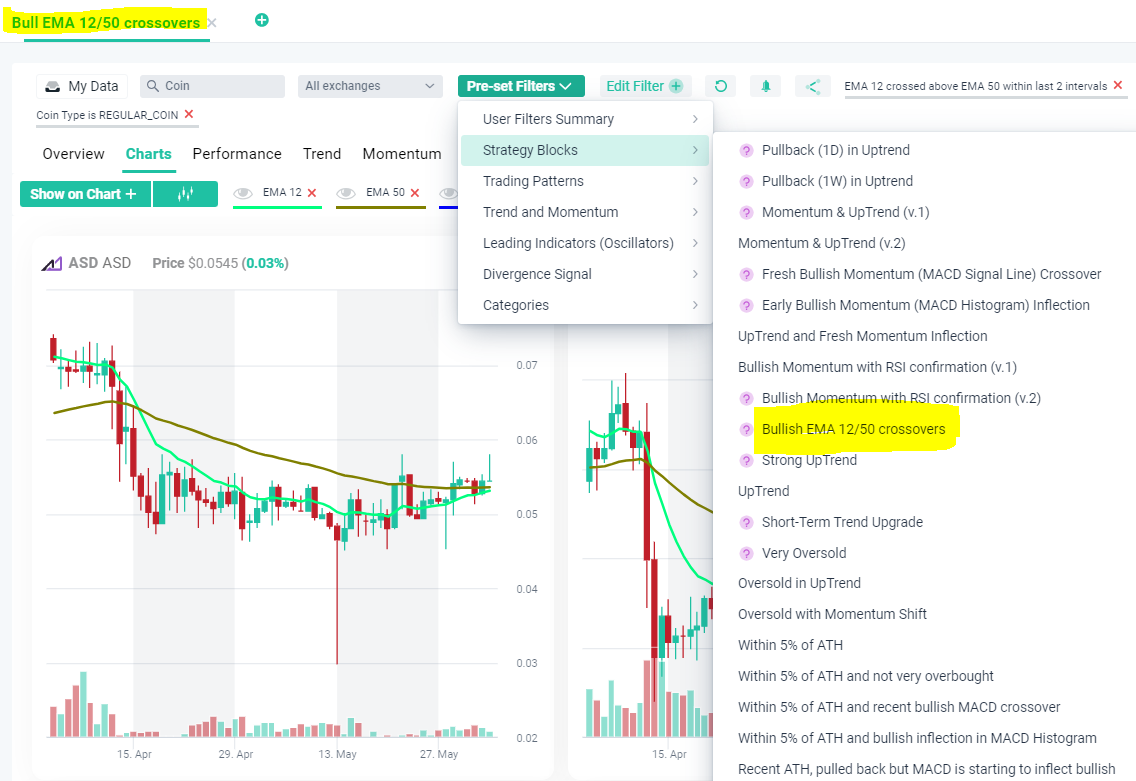

This screen finds coins where EMA 12 recently (last 2 days) crossed above EMA 50 and Price is above EMA 12.

See live market scan results for EMA 12/50 crossovers.

Trading rules:

- Buy when EMA 12 crosses above EMA 50 and Price is above EMA 12

- Sell when EMA 12 crosses below EMA 50

- Place a Stop Loss order (or Alert) below the prior low

>>> See bullish EMA 12/50 crossovers <<<

You can access this and other trading strategy market scans available in the Screener’s Pre-Set Filters:

0 Comments

Leave a comment