Daily Crypto News - Market Sentiment

The cryptocurrency market is experiencing notable turbulence as we close out March, with major tokens seeing pullbacks amid significant macro and on-chain developments. Here’s a structured overview of today’s key metrics, narratives, and signals shaping the space.

Listen to Today’s Crypto News in the Podcast

Top Crypto Daily News

Bitcoin Faces Pressure as US Trade Deficit Hits $301 Billion

The United States reported a record two-month goods trade deficit of $301 billion, with monthly deficits of $153.3 billion in January and $147.9 billion in February. This significant trade imbalance has heightened economic uncertainty, leading investors to seek safe-haven assets like gold. Consequently, Bitcoin, which often correlates with U.S. financial markets, may experience increased volatility in the coming months.

Upbit Announces Record-High Dividend for Shareholders

Dunamu, the parent company of South Korea’s largest cryptocurrency exchange, Upbit, has tripled its cash dividends to 8,777 Korean won ($5.99) per common share, totaling approximately 300 billion won ($204.5 million). This increase follows an 85.1% rise in operating profit to 1.18 trillion won ($809 million) and a 22.2% increase in net profit to 983.8 billion won ($671 million) for 2024.

Binance Reveals First Crypto ‘Vote to List’ Results—Only 4 Tokens Pass the Final Cut

Binance’s inaugural “Vote to List” campaign concluded with four tokens selected for listing after receiving over 185,000 votes. This initiative underscores Binance’s commitment to community-driven listings and emphasizes the importance of transparency and risk assessment in the token selection process.

Source: altFINS Editor’s Picks

Market Sentiment

Crypto Fear & Greed Index: Currently sits at 44 – signaling Fear. Investors are cautiously navigating the volatility triggered by macroeconomic developments and institutional shifts. (Source: alternative.me)

Narrative Momentum: The market is reacting to news of impending Bitcoin and Ethereum options expirations and geopolitical uncertainty, notably new U.S. tariffs and regulatory reshuffling. (Sources: CoinDesk, Barron’s)

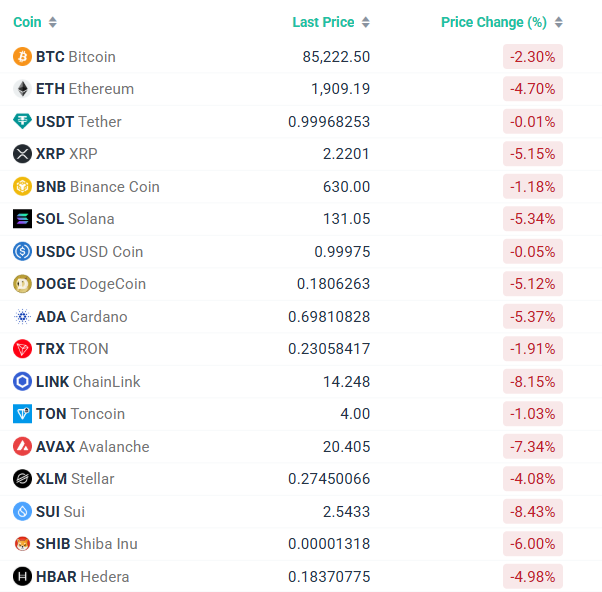

Market Performance

On-Chain Metrics

Bitcoin (BTC)

- Active Addresses: Up 5% to 1.1 million (Source: Riotimes Online)

- Transaction Volume: Increased 15% to 3.5 million transactions (Source: Riotimes Online)

- Options Expiry: 139,000 BTC set to expire today ($12.1B notional), max pain at $85,000 (Source: Blockchain.news)

- Macro Divergence: The Bitcoin Macro Index shows bearish divergence (price rising while the index falls) (Source: TradingView/Cointelegraph)

Ethereum (ETH)

- Active Addresses: Down 3% to 500,000 (Source: Riotimes Online)

- Whale Activity: One major holder offloaded 6,505 ETH (~$12.76M) (Source: ChainCatcher)

- Options Expiry: 301,000 ETH expiring ($2.13B notional), max pain at $2,400 (Source: Blockchain.news)

- Blockchain Growth: Full sync data size now 1,269.25 GB (Source: YCharts)

Derivatives and Liquidity

- Open Interest & Liquidations: Traders are repositioning ahead of the massive options expiry event. (Source: Coinglass, Blockchain.news)

- Funding Rates: Elevated funding on long positions signals a slightly overheated derivatives market. (Source: Coinglass)

Exchange Flows

- Bitcoin ETFs: Net inflows of $89M on March 27. Fidelity’s FBTC led with $97.14M. (Source: CryptoNews.com)

- Ethereum ETFs: Net outflows of $4.2M, with VanEck and Fidelity recording the most redemptions. (Source: Binance Square)

- Stablecoin Flows: USDT and USDC inflows to exchanges are rising, possibly indicating dry powder for future buys. (Source: Santiment, Whale Alert)

DeFi & Layer 2 Activity

While specific numbers weren’t available today, DeFi TVL and Layer 2 throughput (Arbitrum, Optimism, Base) continue trending upward, albeit modestly. These metrics remain key indicators of real economic activity on-chain. (Source: L2Beat, DeFiLlama)

Macro & Regulatory

- Trump’s SEC Nominee: Paul Atkins, a known crypto advocate, may signal a shift toward a more open regulatory framework. (Source: MarketWatch)

- Trump-Linked Stablecoin: “USD1” – a new stablecoin initiative backed by U.S. Treasuries, may soon enter circulation. (Source: The Times UK)

- Fidelity: Plans to launch its own stablecoin, signaling further TradFi integration. (Source: Financial Times)

Summary

March 28 wraps up a volatile yet foundational day for crypto. While prices have corrected, investor interest remains evident through ETF inflows and rising network activity. With major options expiries upon us and regulators warming to digital assets, the landscape is shifting rapidly. Caution remains warranted — but opportunity is brewing beneath the surface.

Stay tuned and stay sharp.

Visit altFINS for more daily market breakdowns, trend analysis, and trading insights.

0 Comments

Leave a comment