Daily Crypto News: Bitcoin Dips, Ethereum Struggles, and Memecoins Face Pressure

The cryptocurrency market has been highly volatile over the past week, with major assets experiencing sharp declines. Here’s a concise breakdown of the latest trends:

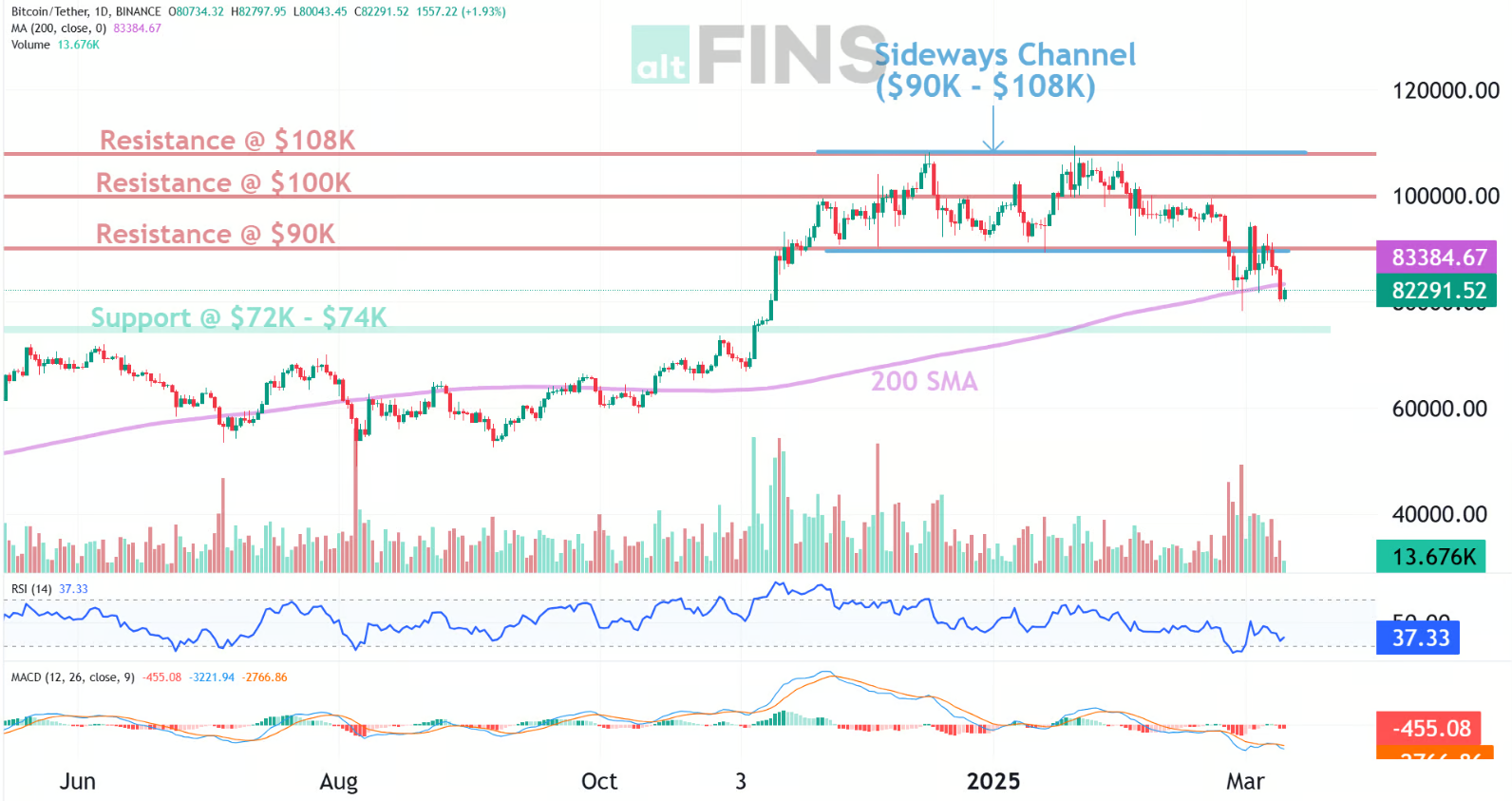

Bitcoin (BTC) Faces Resistance

- BTC dropped from its recent high of $92,000 and is currently struggling to hold above the $80,000 support level.

- Key resistance levels lie at $83,000 and $85,000, while a failure to hold above $80,000 could trigger further declines toward $78,000 or even $75,000.

- Analysts remain divided: some see a recovery ahead, while others predict further sell-offs if BTC remains below $85,000.

- Find live BTC analysis here.

Ethereum (ETH) Under Pressure

- ETH has dropped below $2,300, struggling against both Bitcoin’s dominance and Solana’s rising popularity.

- Concerns over Ethereum’s scalability and high transaction fees are pushing investors towards alternatives like Solana, Tron, and XRP.

- Large wallet accumulation of ETH has slowed down, signaling reduced confidence in the asset’s short-term performance.

- A further drop to $1,800 is possible if Ethereum fails to reclaim key resistance levels.

Memecoins and Alternative Assets

- Memecoins such as Dogecoin (DOGE) and other speculative tokens have faced steep declines, with DOGE dropping by over 10% recently.

- Analysts believe that despite the sell-off, some memecoins could see massive rebounds (300%-500%) in the next cycle.

- Interest in memecoins remains strong, but their volatility makes them high-risk investments.

Solana’s Growing Influence

- SOL has seen increased adoption due to its faster transactions and lower fees compared to Ethereum.

- Despite a recent drop below $130, Solana is maintaining strong support levels.

- The potential for a Solana ETF could boost the asset’s long-term prospects and challenge Ethereum’s dominance in DeFi and NFTs.

Macroeconomic Impact and Political Factors

- U.S. Commerce Secretary Howard Lutnick dismissed recession fears, but economic concerns persist.

- Trump’s recent announcement about a U.S. Bitcoin Reserve briefly pushed BTC prices up, but subsequent tariff increase announcements erased those gains.

- Crypto firms like Coinbase and Ripple face scrutiny for political donations, raising concerns about regulatory risks.

Market Outlook

- Bitcoin’s ability to reclaim $85,000 will be a key factor in determining overall market direction.

- Ethereum must overcome resistance near $2,300-$2,500 to regain investor confidence.

- Altcoins like Solana could continue to gain market share as Ethereum struggles.

- Memecoins remain speculative but could see renewed interest if the market stabilizes.

Stay tuned for more updates as the crypto landscape continues to evolve.

Source: https://altfins.com/crypto/editorsPicks

0 Comments

Leave a comment