Cryptocurrency Price Analysis - week 21 and YTD (2021)

Cryptocurrency Analysis – week 21 and YTD, 2021

BOUNCE FADED… SITTING AT CRITICAL LEVELS

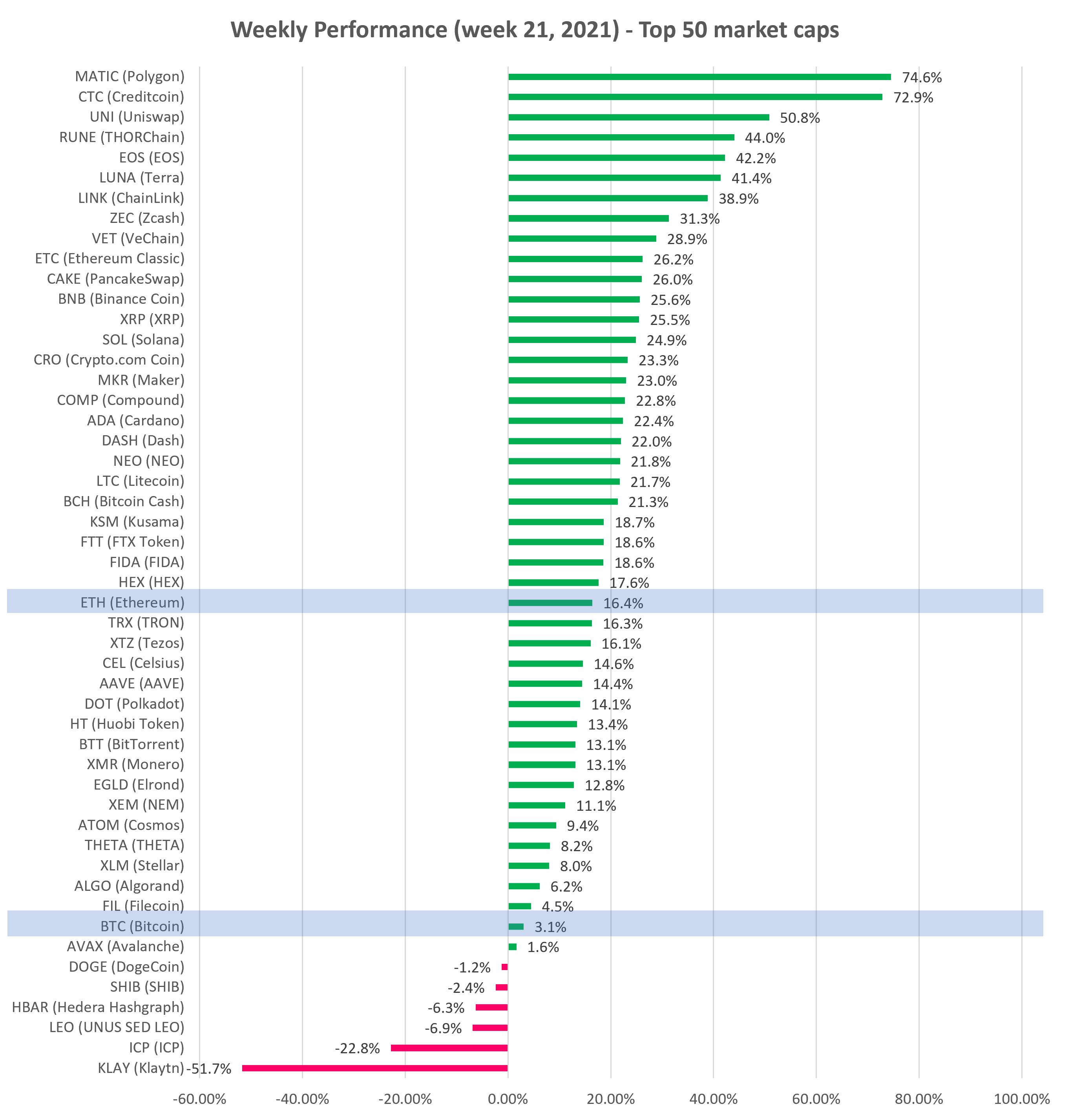

Bitcoin and altcoins bounced last week following massive (40-70%) declines, but then prices faded. BTC ended the week up mere +3.1% and Ethereum (ETH) was up +16.4% (vs prior week’s -24.7% and -41.0%, respectively).

Most altcoins are now sitting at or near critical support levels and trends have deteriorated.

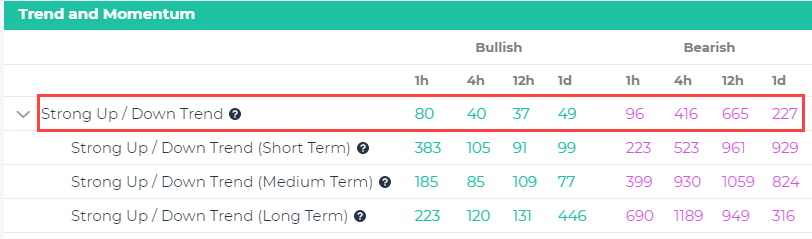

Our Signals Summary page indicates that very few coins remain in an Uptrend on Short- or Medium-Term basis. Far more are in a Downtrend now (see table below).

Thus, the near term upswing could simply be a short-lived bounce.

Trading strategies should adopt to the environment, which clearly has switched from bullish uptrend to bearish downtrends (i.e. crypto bear market), in general.

Here’s our view on what traders could do (read in blog):

1. Buy dips and try to time the bottom (not recommended in downtrend).

2. Wait for prices to stabilize and for momentum upswing.

3. Use Patterns for swing trading.

4. Find Patterns with bullish breakouts.

5. Use Patterns signals to Buy and Short Sell – market neutral portfolio

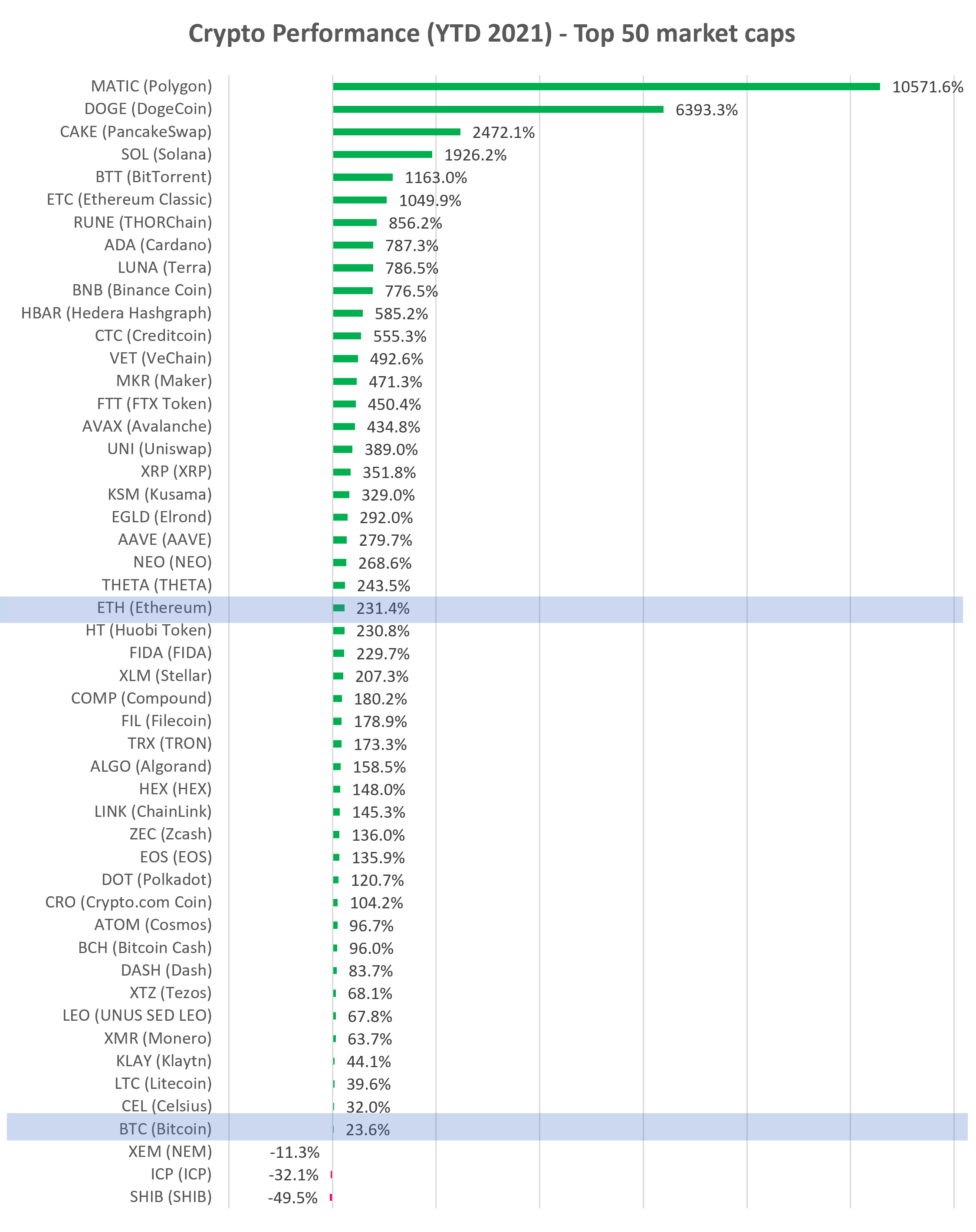

See top 50 coins by market cap “Performance” tab on our platform (see charts below). Check our curated charts for technical analysis of top 30 altcoins.

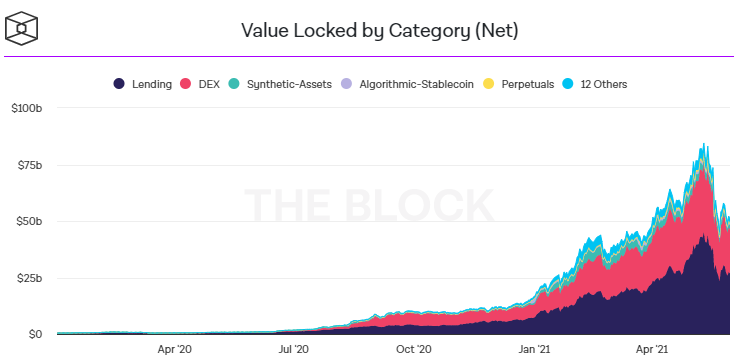

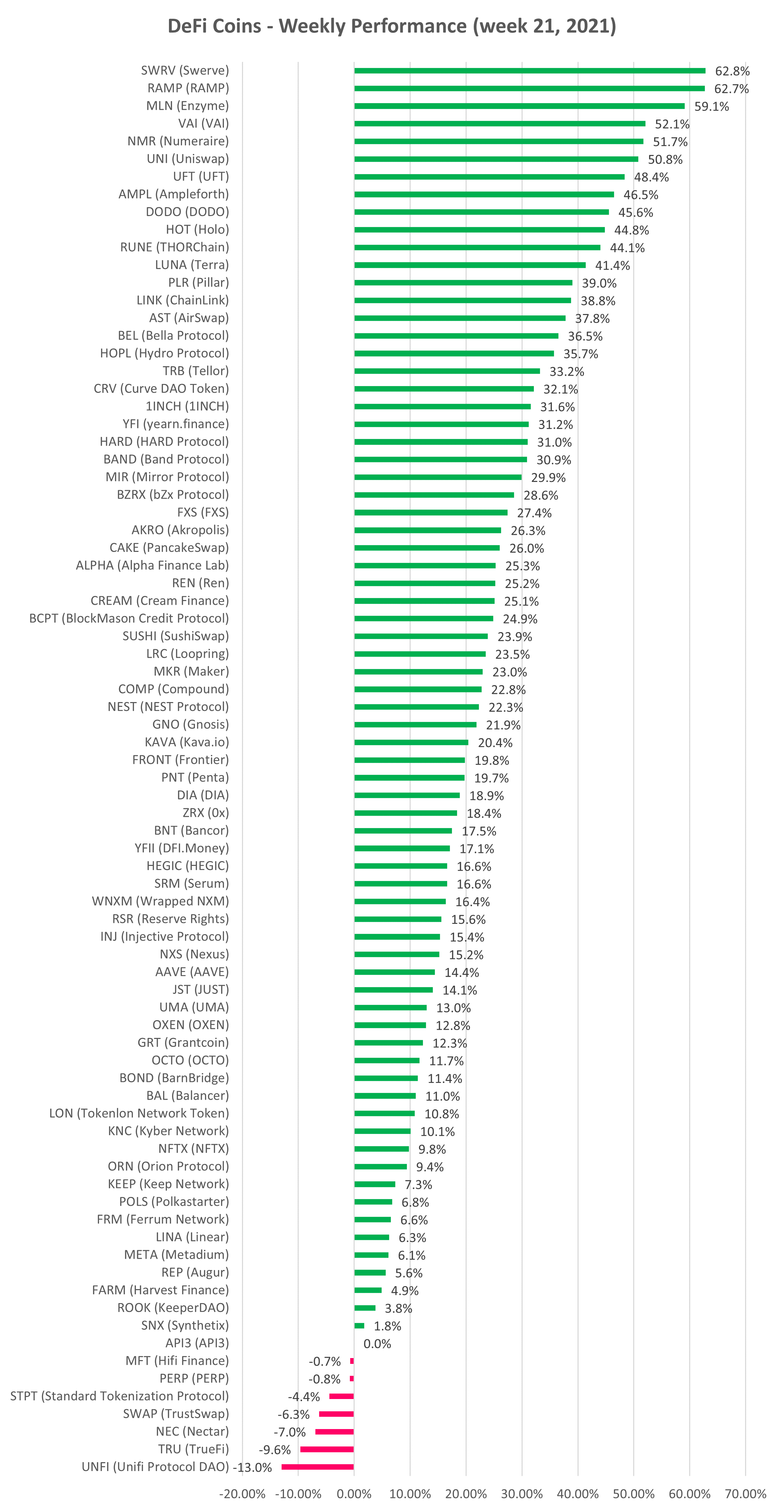

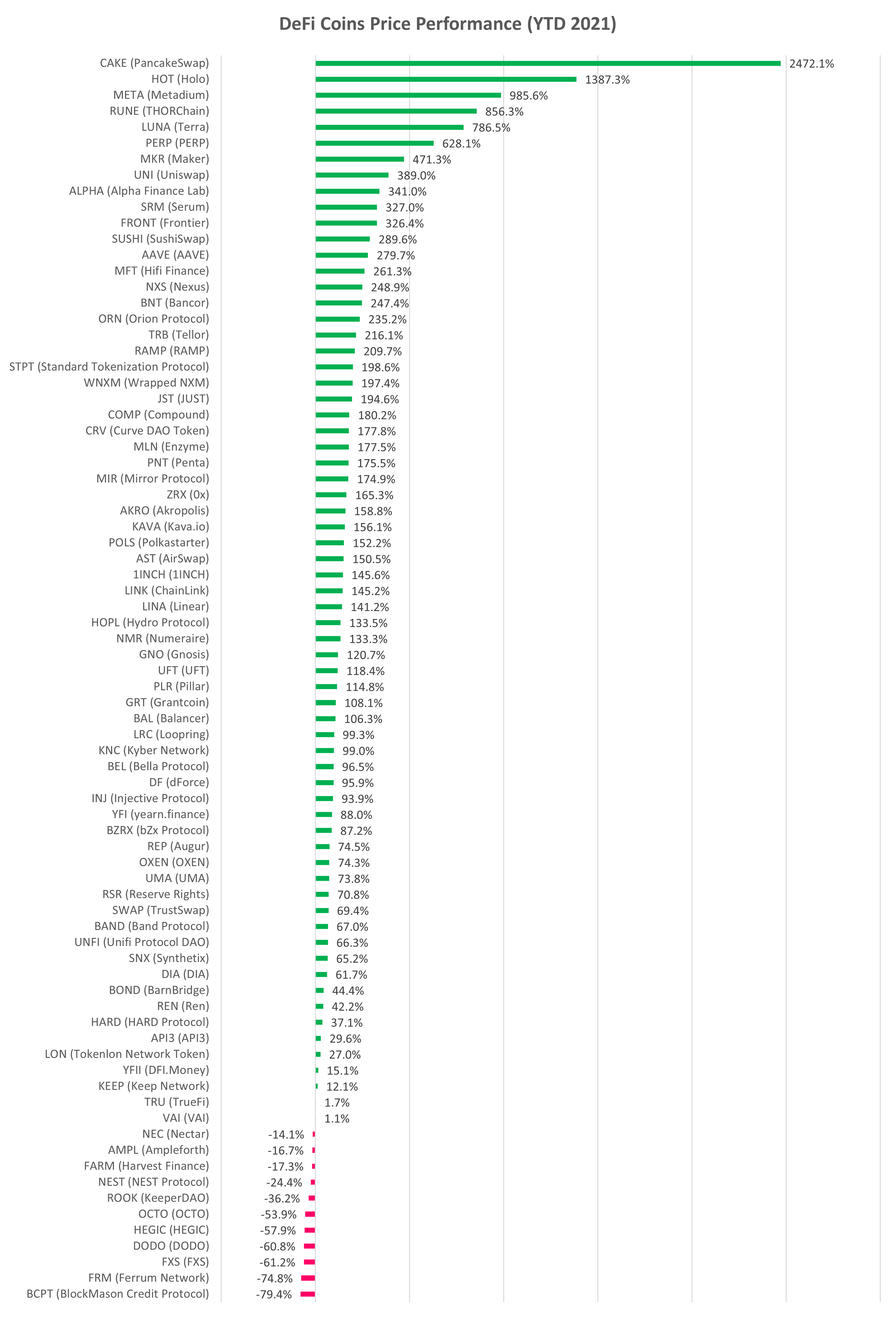

Decentralized Finance (DeFi) – Total Value Locked (TVL) modestly improved last week to $51B, +7% w/w (versus -35% in prior week), and is up +209% YTD.

DeFi cryptocurrency prices also bounced (see below). Total DeFi category market cap also improved last week by +17% (versus -41% in prior week), and is up +315% YTD (i.e. ~ 4.1x).

Source: altFINS.com

Source: altFINS.com

Check our unique automated chart pattern recognition for fresh trading ideas. Also, during market corrections, it’s always good to revisit coins in an Uptrend but with a pullback. Our Signals Summary has this and other pre-defined filters ready for action.

Subscribe to our newsletter to receive future blog updates in your inbox and make sure you add altfins.com to your email whitelist.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.