Cryptocurrency Price Analysis - week 18 and YTD (2021)

Cryptocurrency Analysis – week 18 and YTD, 2021

Lead by Ethereum, altcoins continue to advance

Bitcoin continued to be range-bound this week as Ethereum again saw strong gains. Ethereum surpassed the $4K level, taking its network value to over $470B. According to Blockchain, the Ethereum network has seen the total number off addresses continue to rise steadily from the beginning of the year; the number of large transactions has increased while the ratio of short-term holders to long-term holders remains steady.

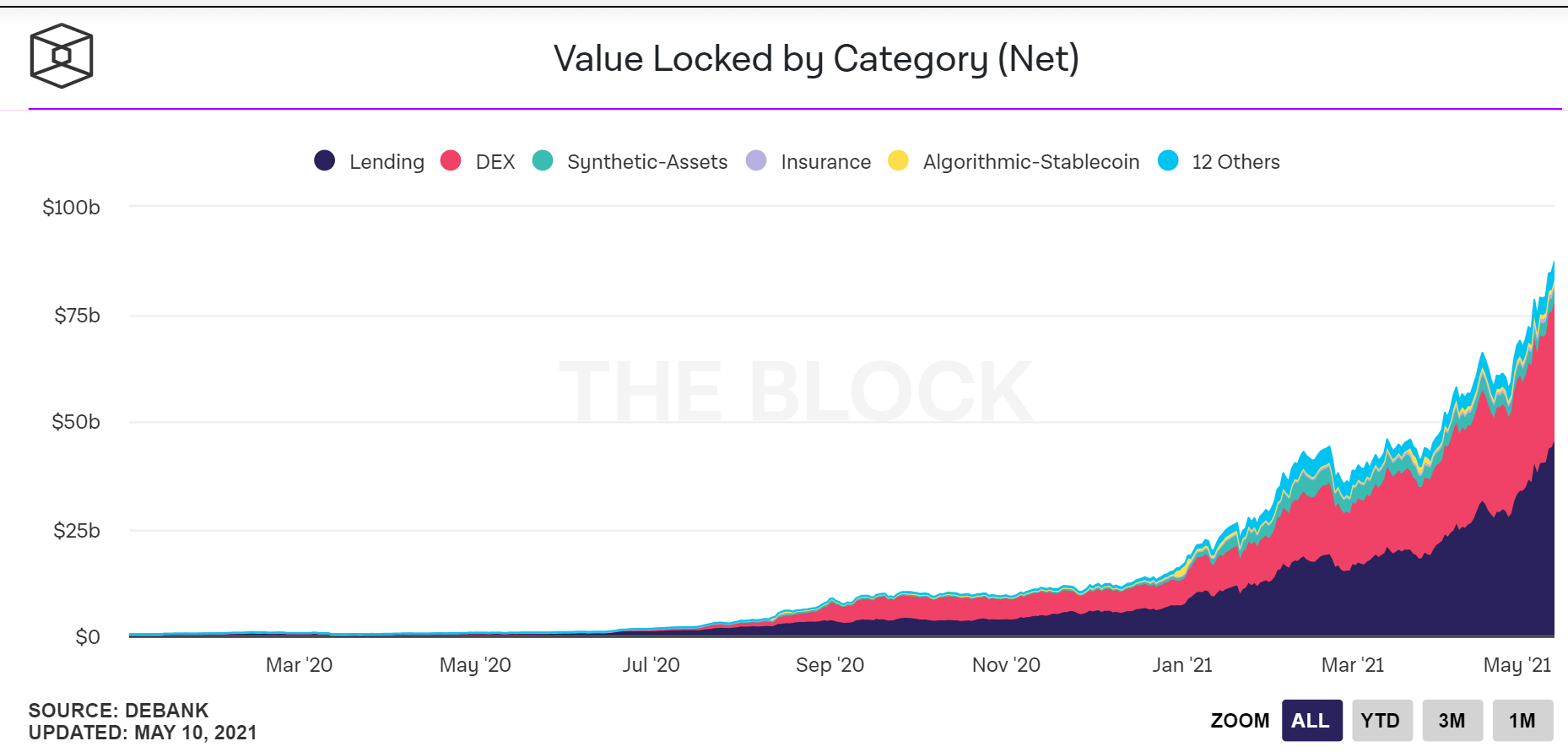

Looking further into the De-Fi activity on ETH network, the vast majority of the top-use cases by locked-in value are involved in lending and running exchanges. Over the last 90-days, the amount of value that was locked-in some type of De-Fi contract has more than doubled, and is currently around $85B.

The trend of Institutional adoption is continuing with the S&P rolling-out digital asset indices and NYDIG announcing that U.S. bank customers will be able to buy, hold and sell Bitcoin through their existing accounts in the coming months. Also of note, Bridgewater Associates CFO John Dalby has left the fund manager to become CFO of NYDIG.

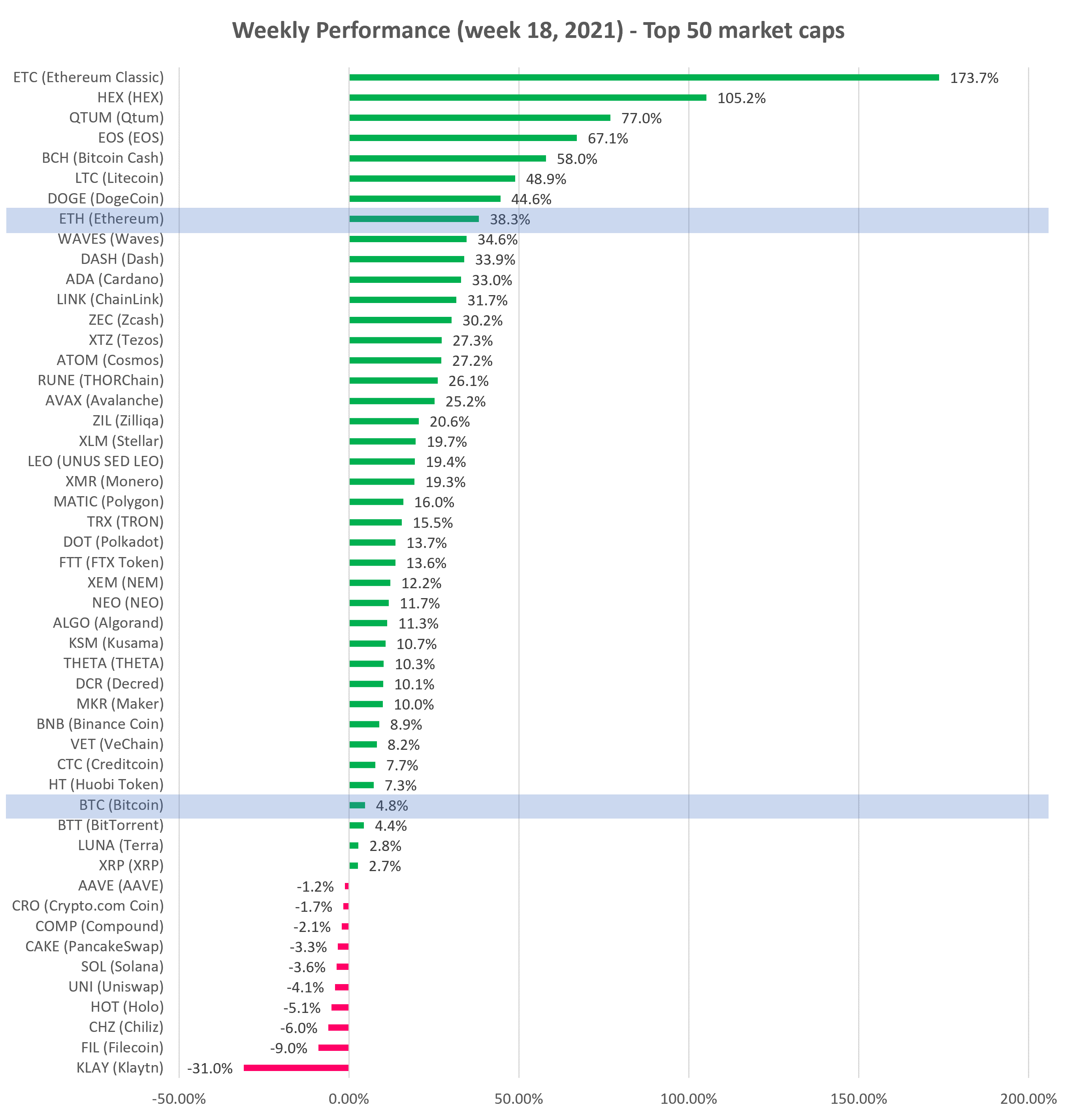

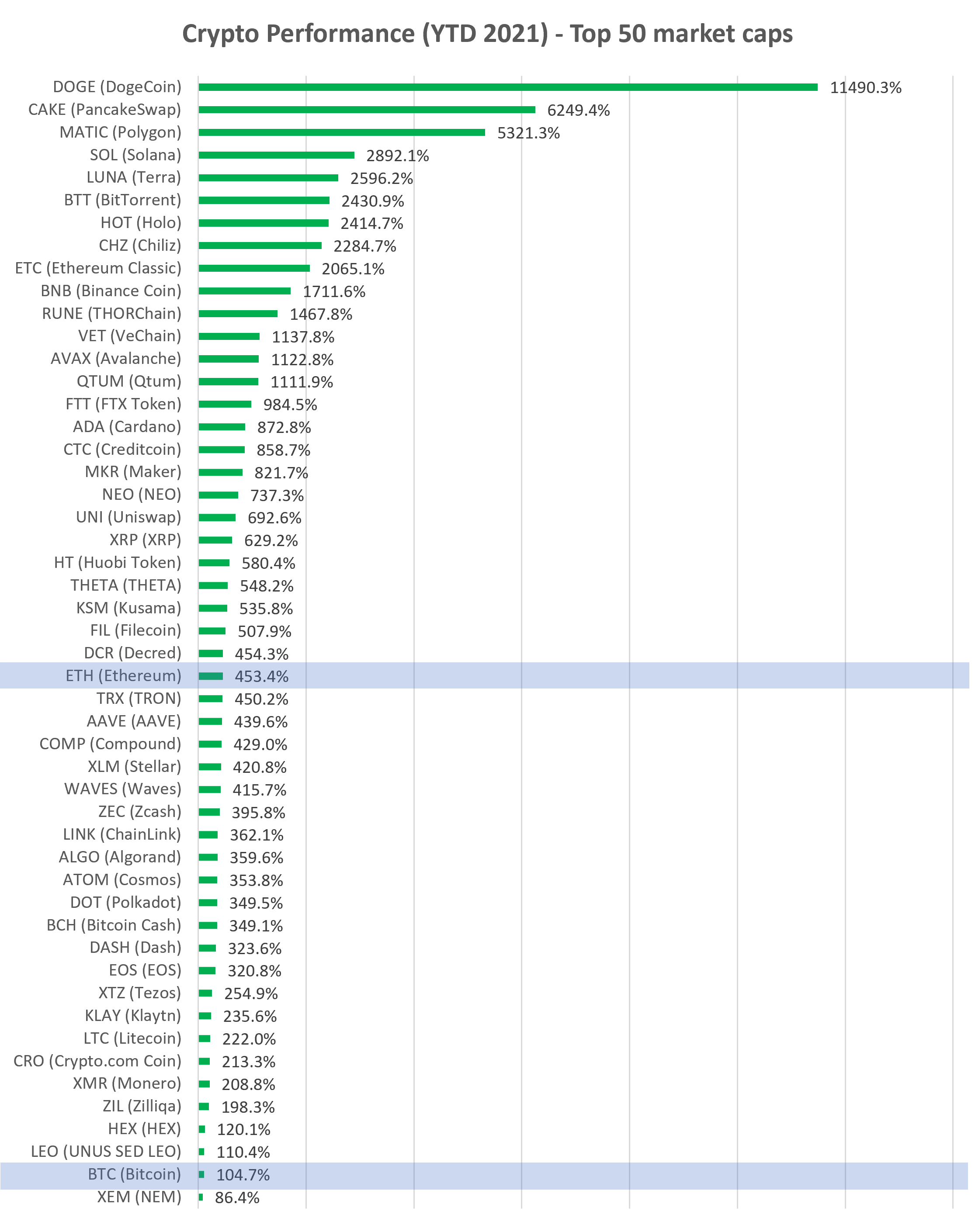

See top 50 coins by market cap “Performance” tab on our platform (see charts below).Check our curated charts for technical analysis of top 30 altcoins (click on curated charts tab).

Bitcoin (BTC) continue to recover, up 4.8% and Ethereum (ETH) ripped another +38.3% (vs prior week’s +18.2% and +36.4%, respectively).

Source: altFINS.com

Source: altFINS.com

Decentralized Finance (DeFi) – Total Value Locked (TVL) increased last week to $71B, +25% w/w and +330% YTD.

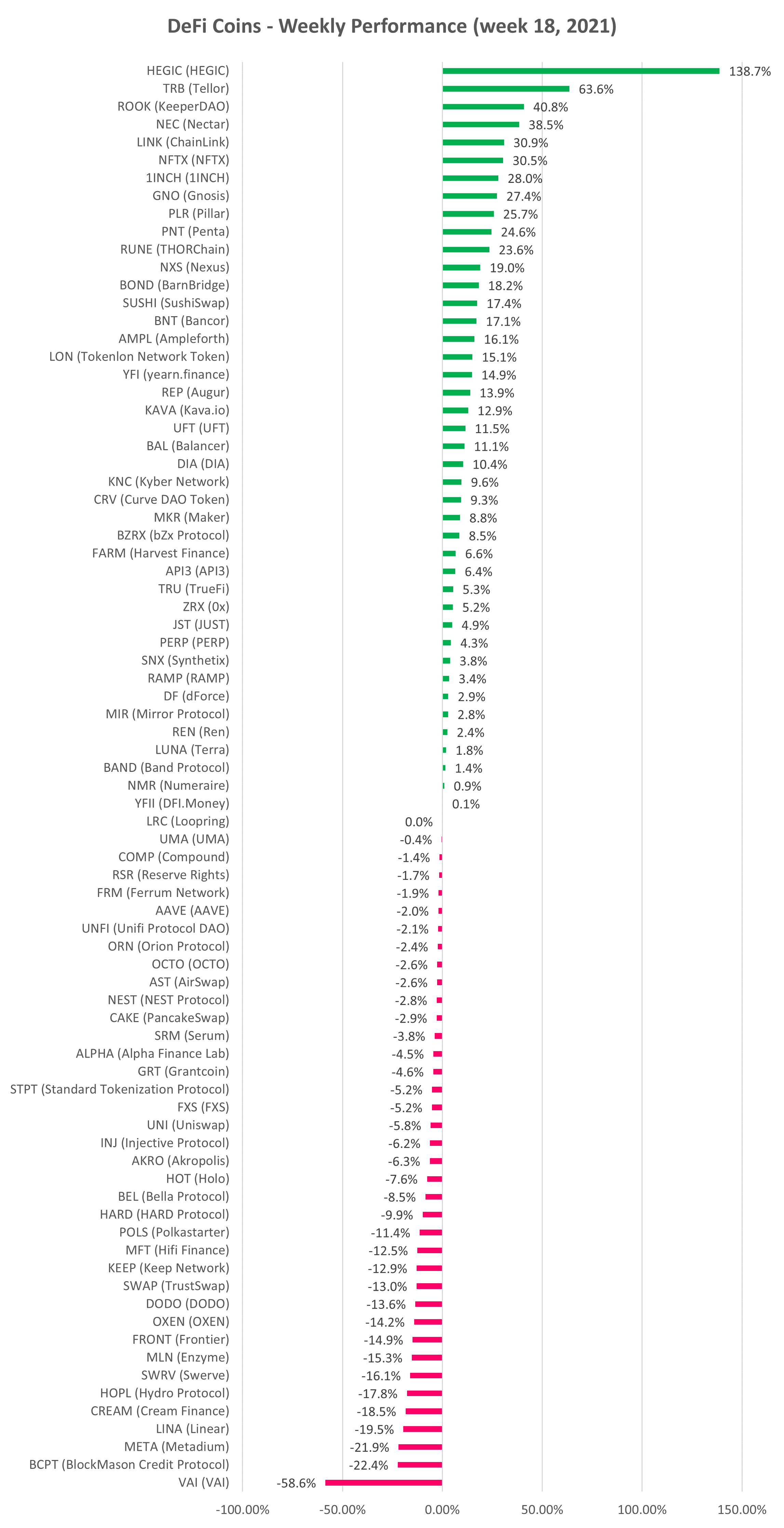

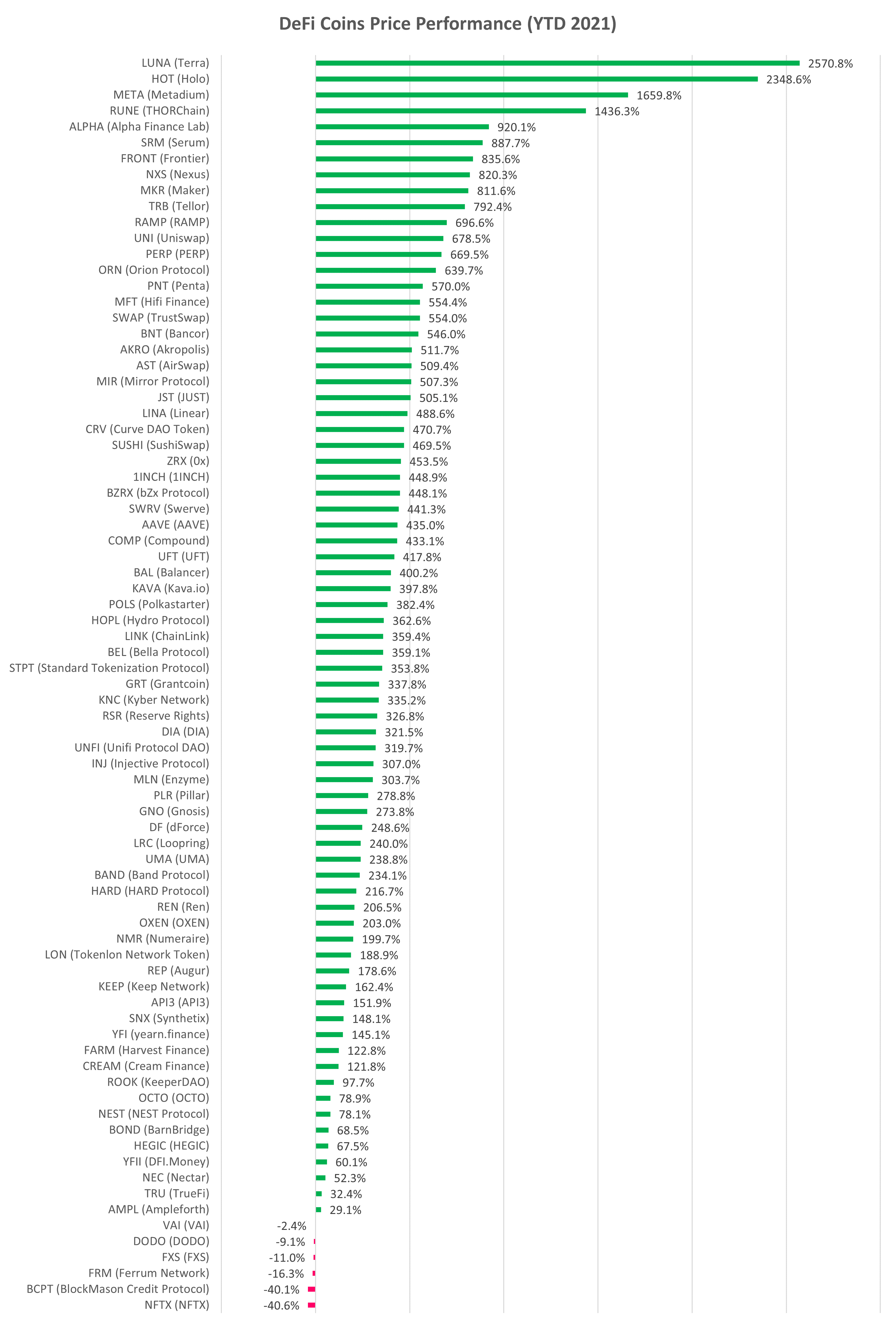

DeFi cryptocurrency prices were mixed (see below). Total DeFi category market cap also increased last week by 18% and is up +528% YTD (i.e. ~ 6.3x).

Source: altFINS.com

Source: altFINS.com

Check our unique automated chart pattern recognition for fresh trading ideas. Also, during market corrections, it’s always good to revisit coins in an Uptrend but with a pullback. Our Signals Summary has this and other pre-defined filters ready for action.

Subscribe to our newsletter to receive future blog updates in your inbox and make sure you add altfins.com to your email whitelist.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.