How To Trade Using Ultimate Oscillator (UO)?

In the fast-paced world of cryptocurrency trading, finding the right indicators can make all the difference. It’s used by traders identify overbought and oversold conditions. In this article, we’ll delve into how the Ultimate Oscillator works and how it can help you in crypto trading.

Understanding the Ultimate Oscillator

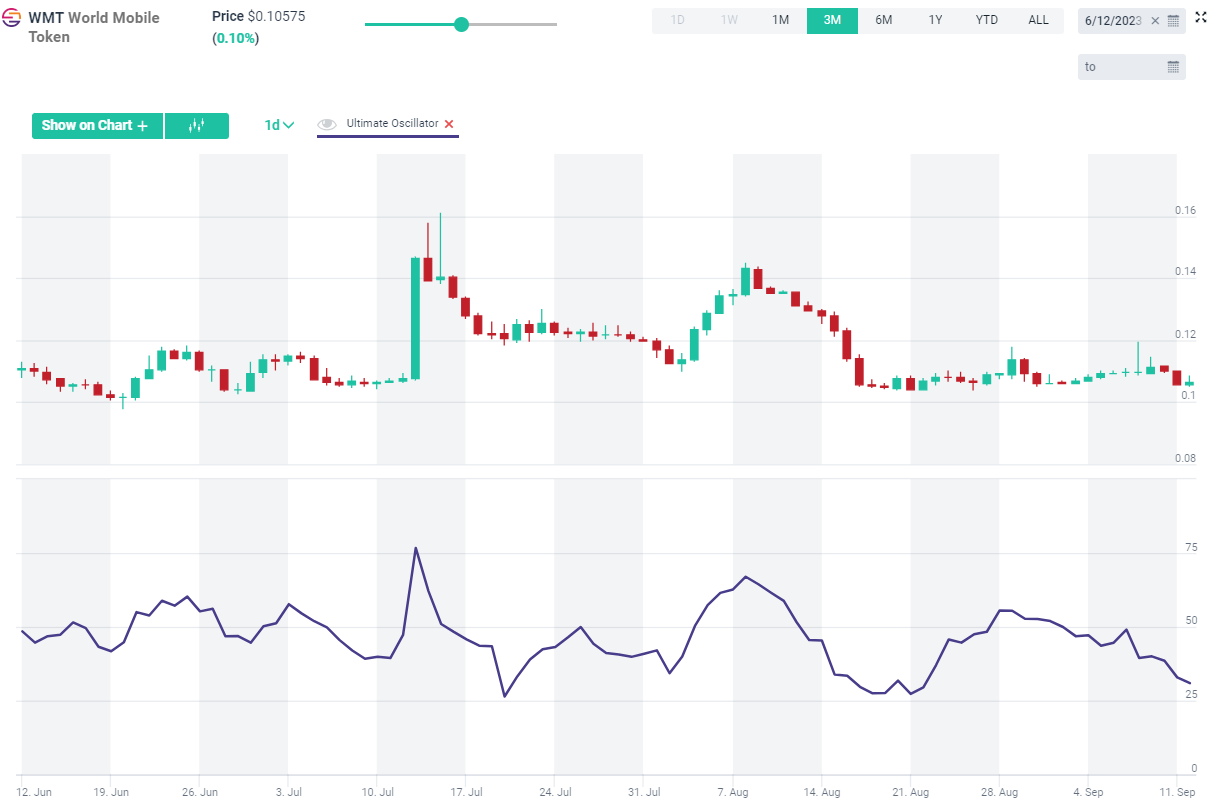

The Ultimate Oscillator is a versatile indicator with values ranging from 0 to 100. It plays a crucial role in crypto trading by helping traders identify overbought and oversold conditions. When the UO registers a reading above 70, it signals an overbought market, suggesting that a reversal or correction may be imminent. Conversely, a UO reading below 30 indicates an oversold condition, suggesting a potential buying opportunity.

Measuring Momentum Across Timeframes

One of the standout features of the Ultimate Oscillator is its ability to measure momentum across multiple timeframes. This characteristic makes it a valuable tool for assessing the strength of buying pressure in the crypto market. When buying pressure is robust, the UO rises, and when it weakens, the UO falls. This dynamic aspect of the indicator allows traders to gauge market sentiment and make strategic moves accordingly.

Reduced Volatility, Enhanced Precision

The Ultimate Oscillator sets itself apart from many other indicators by employing a weighted average of three different timeframes. This approach minimizes volatility and results in fewer trade signals compared to single-timeframe indicators. For traders, this means fewer false signals and a clearer picture of market trends.

Calculating the Ultimate Oscillator

To calculate the Ultimate Oscillator, you’ll need to follow a specific formula:

- Buying Pressure: Calculate the Buying Pressure by subtracting the lesser of the low or prior close from the close for the chosen period.

- True Range: Determine the True Range by subtracting the lesser of the low or prior close from the higher of the high or prior close for the same period.

- Averages: Calculate the ratio of Buying Pressure to True Range for three different timeframes: 7-day, 14-day, and 28-day periods.

- Ultimate Oscillator: Finally, create a weighted average of the three averages to generate the Ultimate Oscillator value.

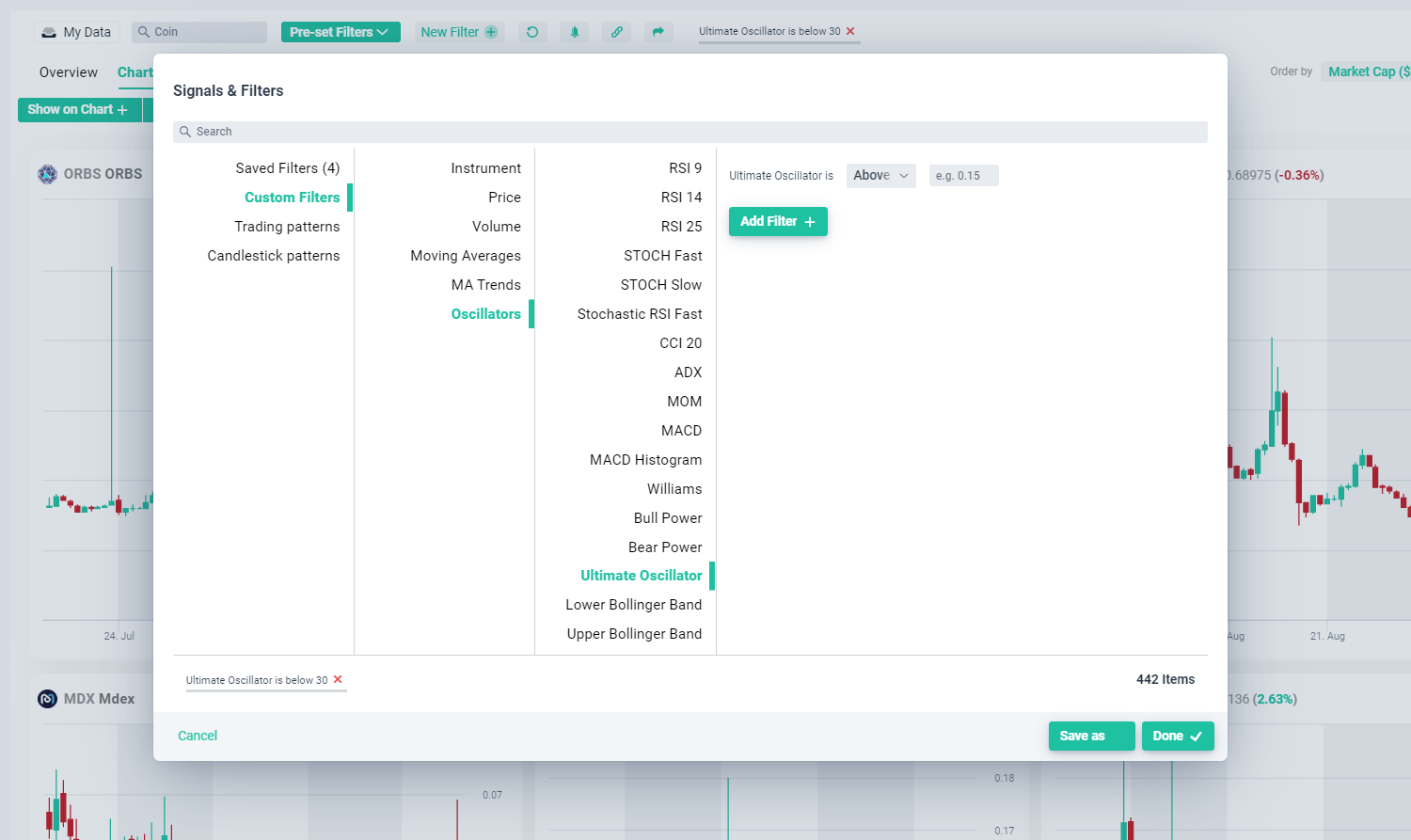

Trading Signals with the Ultimate Oscillator on altFINS platform

The Ultimate Oscillator is available filter option within altFINS Crypto Screener. Our award winning Crypto Screener empowers traders and investors to craft custom definitions, save their unique filters, and even set up alerts based on their chosen criteria.

In crypto trading, the Ultimate Oscillator becomes a powerful ally when it generates signals. Pay close attention to instances where the price moves in the opposite direction to the UO reading. These divergences can provide valuable insights into potential trend reversals or significant market shifts.

In conclusion, the Ultimate Oscillator is a must-have tool for any crypto trader’s toolkit. Its ability to measure buying pressure, identify overbought and oversold conditions, and provide precise signals across multiple timeframes can greatly enhance your trading strategy. By incorporating the UO into your analysis, you’ll be better equipped to navigate the exciting and sometimes turbulent waters of cryptocurrency trading.

0 Comments

Leave a comment