Crypto Market Weekly Recap: Bitcoin, Altcoins and Macro

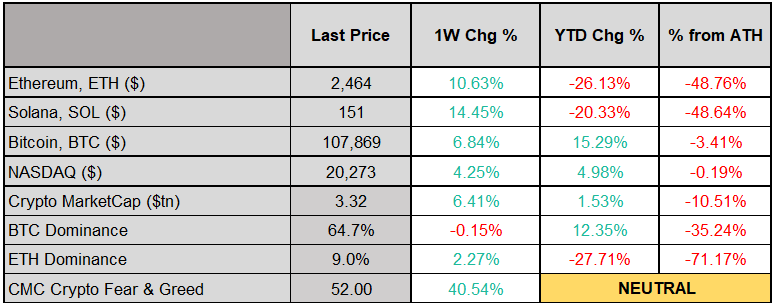

The crypto market ended the week strong, with major coins like Ethereum and Solana posting double-digit gains. Traditional markets also advanced, with the NASDAQ logging a solid increase, signaling broad investor optimism across asset classes.

📈 Market Summary

Bitcoin (BTC) rose by 6.8%, Ethereum (ETH) surged by 10.6%, and Solana (SOL) jumped 14.5%. The NASDAQ also gained 4.3%, closing the week at $20,273.

Year-to-date, Bitcoin is up 15.3%, while Ethereum and Solana remain in the red at -26.1% and -20.3%, respectively. NASDAQ has gained 5% YTD.

The total crypto market cap increased to $3.32 trillion (+6.4% WoW). Bitcoin’s dominance slightly decreased to 64.7%, and Ethereum’s rose to 9.0%. The Crypto Fear & Greed Index climbed to 52, indicating neutral sentiment.

💹 Weekly Price Performance of Top Coins

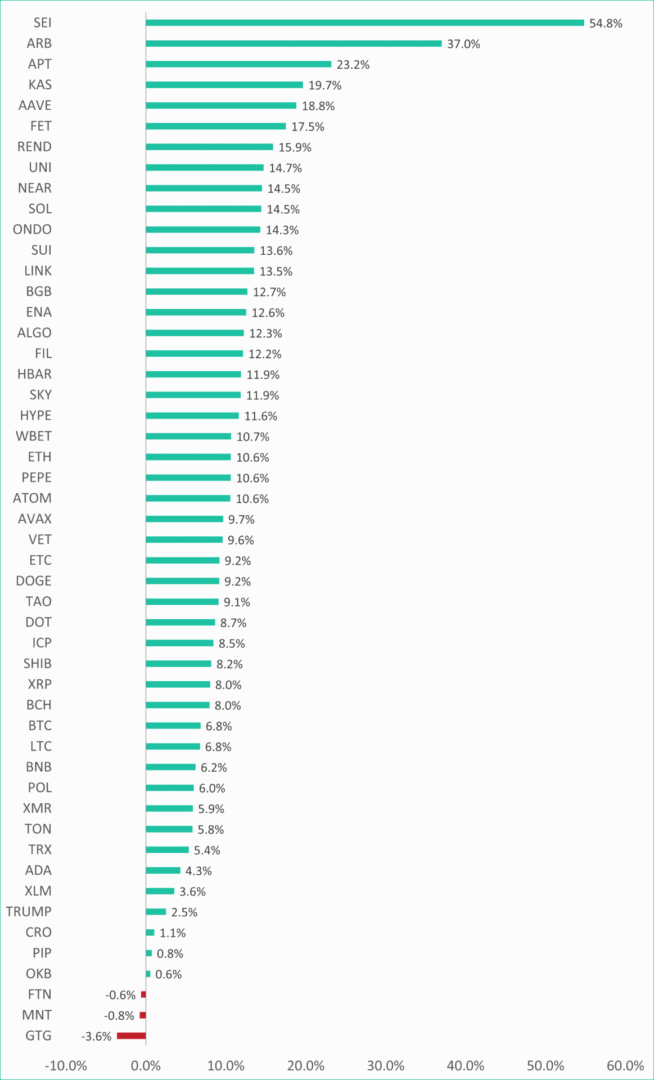

The altcoin market bounced back with broad-based gains. ETH and SOL led the rally.

Top Gainers:

$SEI +54.8%

$ARB +37.0%

$APT +23.2%

TOP Losers:

$FTN -0.6%

$MNT -0.8%

$GTG -3.6%

🔍 On-Chain Data Insights

Top Protocols by Total Revenue:

-

Tron (TRX)

-

PancakeSwap (CAKE)

-

UniSwap (UNI)

Revenue generation signals strong user activity and willingness to pay for protocol services.

Top Protocols by Total Value Locked (TVL):

-

Aave (AAVE)

-

Lido (LDO)

-

EigenLayer (EIGEN)

High TVL reflects user trust in smart contract security and protocol popularity.

📊 Chain Revenues (Last Reported):

-

Bitcoin: $0.5M

-

Ethereum: $0.9M

-

Solana: $1M

Revenues remain subdued across the board. Ethereum has yet to recover to Q1 2024 highs, while Solana’s memecoin boom has faded. Bitcoin remains stagnant due to low transaction volume.

🌍 Macro Highlights

Economic Indicators:

-

U.S. Services PMI: 53.1 (vs. 53 expected)

-

Manufacturing PMI: 52 (in line with expectations)

-

Jobless Claims: 236k (better than expected)

-

Headline PCE: 2.2% YoY (vs. 2.3% expected)

-

Core PCE: 2.7% YoY (above expectations)

Fed Outlook:

-

79% chance of no change in July

-

74% chance of a rate cut in September

-

60% chance of another cut in October

Upcoming Data to Watch:

-

ISM Manufacturing (expected 48.6)

-

ISM Services (expected 50.5)

-

Job Openings and ADP employment reports

-

U.S. Unemployment Rate (expected 4.3%)

📰 Crypto Industry News

-

Institutional Accumulation: A Japanese investment group bought 1,005 BTC, raising its holdings to 13,350 BTC — surpassing Galaxy Digital and CleanSpark.

-

Crypto Fund Flows: Global crypto funds saw $2.7B in net inflows, extending a streak to 11 consecutive weeks. YTD inflows hit $17.8B.

-

Exchange Growth: Hyperliquid surpassed $1.57T in on-chain perpetual trading over the past year, fueled by its HYPE airdrop campaign.

🚀 About altFINS

altFINS empowers crypto traders with cutting-edge tools for analyzing trading signals, on-chain metrics, and executing strategies across exchanges. Discover profitable trade setups and make informed decisions — all in one platform.

0 Comments

Leave a comment