Crypto Market Review Week 43 - 2023: Cryptocurrency vs. Traditional Markets

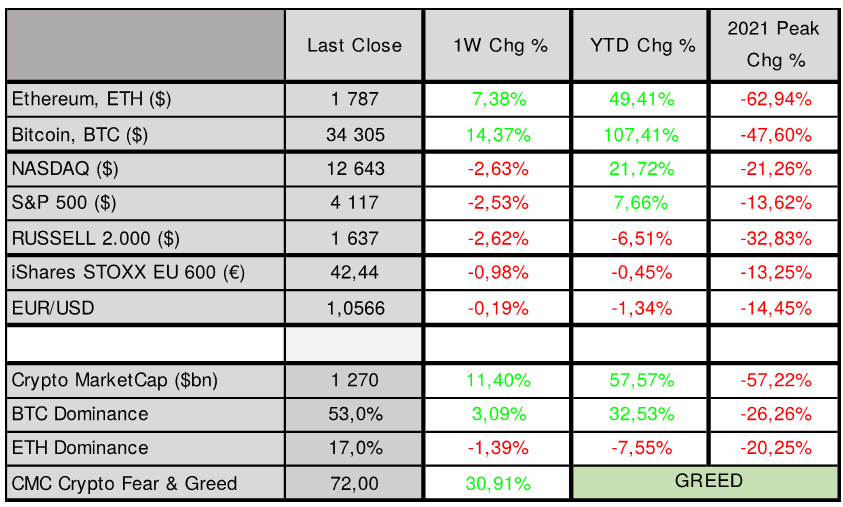

Cryptocurrencies continue to captivate the financial world, with Bitcoin (BTC) and Ether (ETH) taking center stage. BTC was trading at around $34,345 on Monday, marking an impressive 14.4% increase compared to the previous week. ETH saw a robust surge, rising by 7.4% to reach approximately 1,783 USDT.

The cryptocurrency market‘s resilience in the face of global uncertainties and its growing reputation as a safe haven asset became evident. The ongoing excitement surrounding the potential approval of a BTC spot price-based ETF in the United States significantly impacted Bitcoin’s price trajectory. This demonstrated a decoupling between cryptocurrencies and traditional stock markets, particularly during periods of global unrest.

Bitcoin has had an exceptional year, showcasing year-to-date gains of over 100%, underlining its status as a sought-after investment. Cryptocurrencies are increasingly perceived as a hedge against economic instability, with a surge in option activity pointing towards growing interest in the sector.

Weekly Performance

Source: altFINS

Traditional Equity Markets

In contrast to the impressive performance of cryptocurrencies, traditional equity markets experienced a downturn. The NASDAQ index closed at $12,643, marking a 2.6% decrease from the previous week. The S&P 500 fared similarly, ending the week at $4,117, down by 2.5%.

The European Top 600 stocks index followed suit, closing lower by 1% at €42.44 compared to the previous week. These declines were partly attributed to rising tensions between Israel and Hamas, which added to the market’s volatility.

Inflation and Monetary Policy

Inflation remained a key focus, with the US headline Consumer Price Index (CPI) for September 2023 in line with the Federal Reserve’s expectations, standing at 3.70% per annum. The core CPI, which excludes volatile food and energy prices, showed a slight decrease from 4.3% to 4.1% per annum, slightly below the Federal Reserve’s anticipated rate of 4.2%.

The Federal Reserve Bank of Cleveland’s forecasts for October 2023 indicated a potential drop in the US headline inflation growth to 3.32%, while the core US CPI was expected to remain around 4.16% per annum.

As of October 30th, 2023, market expectations suggested a minimal probability of a rate hike during the Federal Reserve’s upcoming meeting in November. The central bank’s future actions were heavily reliant on economic data, and the strength of the US economy could potentially delay interest rate increases.

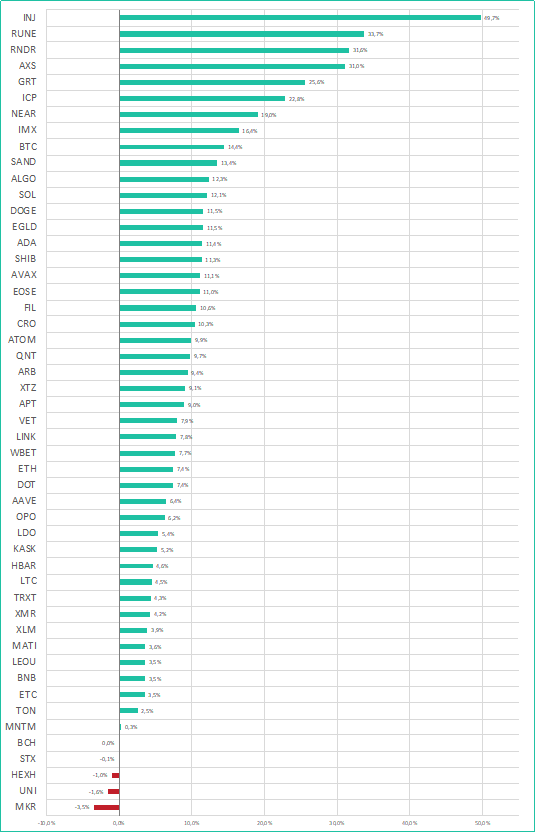

Performance Of Top Coins

Source: altFINS

Spot Bitcoin ETF Approval

A significant development on the horizon is the potential approval of spot Bitcoin (BTC) ETFs. According to JP Morgan, these approvals could enter the market by January 10th, 2024, aligning with the deadline for Ark 21Shares applications. The green light for spot Bitcoin ETFs could open the floodgates for retail investment in the cryptocurrency sector.

Furthermore, prominent institutional players such as Fidelity, BlackRock, BitWise, and others, would be permitted to purchase and hold Bitcoin, effectively reducing its circulation on decentralized and centralized exchanges. This shift could result in a surge in Bitcoin prices and potentially trigger a substantial increase in the overall altcoin market capitalization.

In previous instances, when Bitcoin’s price rose, the altcoin market capitalization also experienced exponential growth, demonstrating the potential for significant opportunities in the cryptocurrency space.

Market Sentiment

The digital asset market sentiment displayed a sense of greed, with a score of 72.00. The total cryptocurrency market cap expanded by over 11% compared to the previous week, reaching approximately $1.27 trillion. Bitcoin’s dominance exceeded 50%, standing at 53%, while Ethereum’s dominance hovered around 17%.

What to Watch For

As we look ahead, several key events are on the horizon:

- FED Monetary Policy Meeting (October 31st – November 01st, 2023): Market participants eagerly await the Federal Reserve’s decisions and outlook on monetary policy.

- ECB Monetary Policy Meeting (December 14th, 2023): The European Central Bank’s meeting will provide insights into the monetary policy direction in the Eurozone.

- Inflation Figures: Keep an eye on Eurozone and US headline and core CPI figures for October 2023, as they will offer valuable insights into inflation trends.

In summary, Week 43 of 2023 brought to the forefront the growing significance of cryptocurrencies as an alternative investment in turbulent times. Bitcoin’s potential spot ETF approval looms large, promising transformative changes in the cryptocurrency market. With traditional markets facing uncertainties, investors are closely monitoring these developments in the evolving financial landscape.

0 Comments

Leave a comment