Crypto Market Review Week 40 - 2023: Markets React to Job Data and Inflation Concerns

Welcome to our weekly macro review for the 40th week of 2023. The global financial markets witnessed significant developments. Bitcoin and Ether (ETH) continued to hold their ground as leading cryptocurrencies, outperforming traditional equity markets. The US job market surprised investors with a robust performance, fueling concerns of prolonged higher interest rates. Inflation remained a central concern, with the headline Consumer Price Index (CPI) showing an increase. In this blog, we will delve into these market events and their implications.

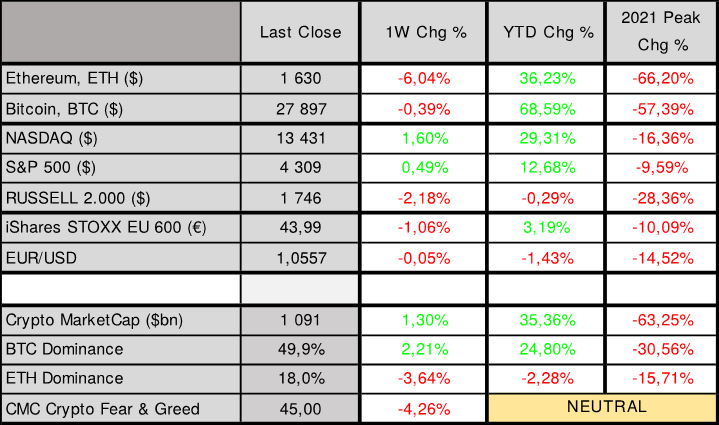

Market Performance

Cryptocurrency Performance

Bitcoin (BTC) and Ether (ETH) have been standout performers in 2023, outpacing equity markets by a significant margin. BTC surged by 69% year-to-date (YTD), while ETH posted a solid 38% gain. In contrast, the NASDAQ index rose by 29%, the S&P 500 by 13%, and the European Top 600 stocks index by a mere 3% during the same period.

The US Job Market Surprises

The Bureau of Labor Statistics reported an unexpected addition of 336,000 new jobs in September 2023, far surpassing the estimated 170,000 jobs. This robust job growth raised concerns among investors that the Federal Reserve might maintain higher interest rates for an extended period. Analysts speculated that the Fed might consider further rate hikes unless the upcoming CPI data indicates a cooling of inflation pressures.

Bond Yields Reach 16-Year High

The unexpectedly strong job data caused bond yields to reach a 16-year high, with 10-year US government borrowing costs hitting levels not seen since 2007. However, it’s worth noting that there is evidence suggesting that the headline US CPI may moderate. Oil prices dropped significantly over the past week, primarily due to the partial lifting of Russia’s fuel export ban and increased concerns about the global economy’s health.

Inflation Concerns Persist

The headline US CPI for August 2023 rose to 3.7% year-on-year, slightly higher than economists’ expectations but better than the Federal Reserve Bank of Cleveland’s forecast. This increase was primarily driven by a 5.6% monthly gain in energy prices, which included a 10.6% surge in gasoline prices.

The Fed’s Outlook

The Federal Reserve anticipates that the core US CPI will decrease to 3.7% by the end of 2023, lower than its earlier projection of 3.9%. Furthermore, the Fed expects inflation to continue to decline, reaching 2.6% in 2024, and only returning to its target of 2% by 2026. The core US CPI, which rose by 4.3% in August 2023, may indicate that the Fed could consider altering its monetary policy tightening strategy sooner than expected.

Market Sentiment and Cryptocurrency Outlook

Market sentiment in the digital asset space dropped slightly to 45.00, signaling a neutral stance compared to the previous week. The total cryptocurrency market capitalization increased by approximately 1.3% and closed the week at around $1.091 billion. Ethereum’s dominance hovered around 18%, while Bitcoin’s dominance remained just below 50%.

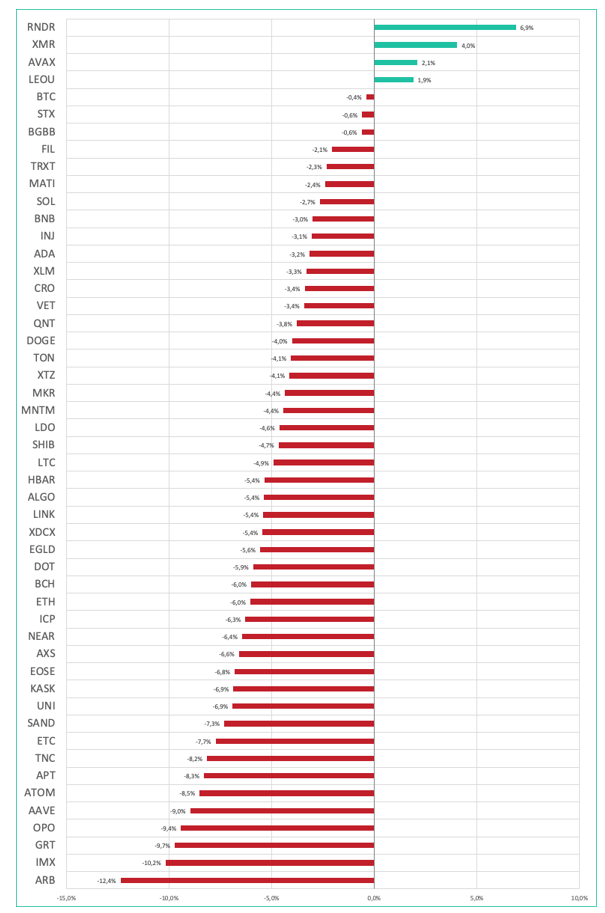

Performance Of Top Coins

What to Watch For

Investors should keep a close eye on several key events in the coming weeks:

- FED Monetary Policy Meeting: The next monetary policy meeting for the Federal Reserve is scheduled for October 31st to November 01st, 2023. Any hints at changes in interest rates or monetary policy could have significant market implications.

- ECB Meeting: The European Central Bank (ECB) will hold its meeting on October 26th, 2023. Decisions made by the ECB can impact not only the Eurozone but also global financial markets.

- US CPI Figures: The US headline and core CPI figures for September 2023 are set to be released on October 12th, 2023, at 08:30 AM ET. These figures will provide insights into the trajectory of inflation.

- Cryptocurrency Developments: Keep a close watch on developments related to Bitcoin ETF applications, as they could serve as catalysts for significant price movements in the cryptocurrency market. Approval of these applications would pave the way for large institutions to invest in Bitcoin.

In conclusion, the financial markets in week 40 of 2023 were marked by surprising job data, concerns about inflation, and the continued dominance of cryptocurrencies like Bitcoin and Ether. As we move forward, monitoring central bank decisions and economic data releases will be crucial for investors and traders alike.

For the latest updates and insights, visit www.altfins.com.

0 Comments

Leave a comment