Crypto Market Recap – Week 12, 2025

The crypto market showed signs of life in Week 12 of 2025, with Ethereum (ETH), Solana (SOL), and Bitcoin (BTC) all posting solid weekly gains. But as always in crypto, there’s more beneath the surface than just price movement. Let’s unpack the week’s key takeaways of the crypto weekly recap.

Listen in the Podcast

Weekly Performance

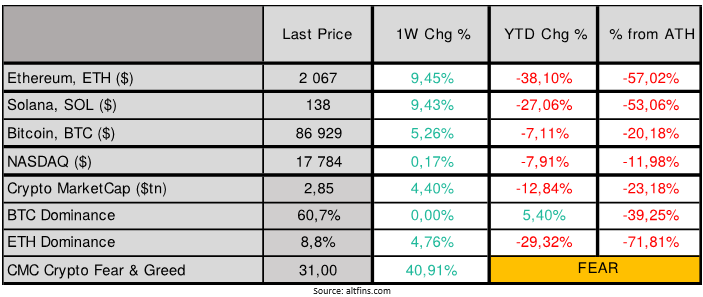

📈 Weekly Price Movers

- ETH: ⬆️ 9.5%

- SOL: ⬆️ 9.4%

- BTC: ⬆️ 5.3%

- NASDAQ: ⬆️ 0.2%

Despite a strong weekly performance, the broader year-to-date (YTD) picture still shows crypto lagging:

- BTC: ⬇️ 7.1%

- ETH: ⬇️ 38.1%

- SOL: ⬇️ 27.1%

- NASDAQ: ⬇️ 7.9%

📊 Market Sentiment & Capitalization

- Fear & Greed Index: 31 (Fear 😬)

- Total Crypto Market Cap: $2.85 Trillion

- Bitcoin Dominance: 60.7%

- Ethereum Dominance: 8.8%

🔍 On-Chain Data Highlights (via altFINS)

Top Coins by Revenue:

- Tron (TRX)

- PancakeSwap (CAKE)

- Lido (LDO)

These projects are seeing the most fee activity—always a sign of real user engagement.

Top Coins by Total Value Locked (TVL):

- Lido (LDO)

- Aave (AAVE)

- EigenLayer (EIGEN)

TVL reflects user trust and protocol traction.

Total Weekly Revenues:

- BTC: $0.8M

- ETH: $0.4M

- SOL: $0.6M

ETH revenues remain historically low, while Solana’s recent revenue surge has cooled due to fading memecoin hype.

Weekly Performance of Top 50 Coins by Market Cap

Top Gainers:

$HYPE +28.2%

$RENDER +18.8%

$AVAX +18.3%

TOP Losers

$OM -5.8%

$LBTC -24.3%

$PIP -32.2%

🧠 Macro Trends Impacting Crypto

- U.S. Retail Sales: +0.2% (below expectations)

- Fed Rate: Held at 4.25%–4.50%

- Economic Indicators: Leading indicators dipped -0.3%

Market Outlook:

👀 The Fed is expected to hold rates steady in May, but there’s a 62% chance of a 0.25% cut in June. A dovish pivot could be bullish for risk assets like crypto.

🔥 This Week in Crypto

- Bitcoin must break above $90K to ignite stronger bullish momentum.

- Ethereum saw an all-time low in weekend burn activity—just $106K worth of ETH was burned.

- The Pectra upgrade is scheduled for testnet deployment on March 26, with a possible mainnet launch around April 26.

Institutional & Industry Highlights

- Metaplanet added $12.6M in BTC after appointing Eric Trump to its advisory board.

- Fidelity launched an Ethereum-based “OnChain” share class for its Treasury fund—bridging TradFi and DeFi.

- Uniswap unveiled a $177M initiative to activate fee-sharing.

- Raydium and Pump.fun are ramping up their memecoin launchpads.

- Converge, a new Layer-1 by Ethena and Securitize, is set to merge TradFi and DeFi. Mainnet is expected in Q2 2025.

💡 altFINS Insight

altFINS continues to empower traders with advanced analytics, technical and on-chain tools, and automated strategy execution across multiple exchanges.

If you’re looking to go beyond the news and into profitable strategies – altFINS is your go-to platform.

0 Comments

Leave a comment