Correction Or Downtrend In Crypto Market?

Crypto and stock markets took a nose dive the last couple of days. Why and is this just correction or start of a downtrend? How should we trade crypto?

We discuss these topics in our VIP Telegram Channel but here’s the gist of it:

Why? Because inflation.

New data on U.S. economy suggests that inflation is creeping up again.

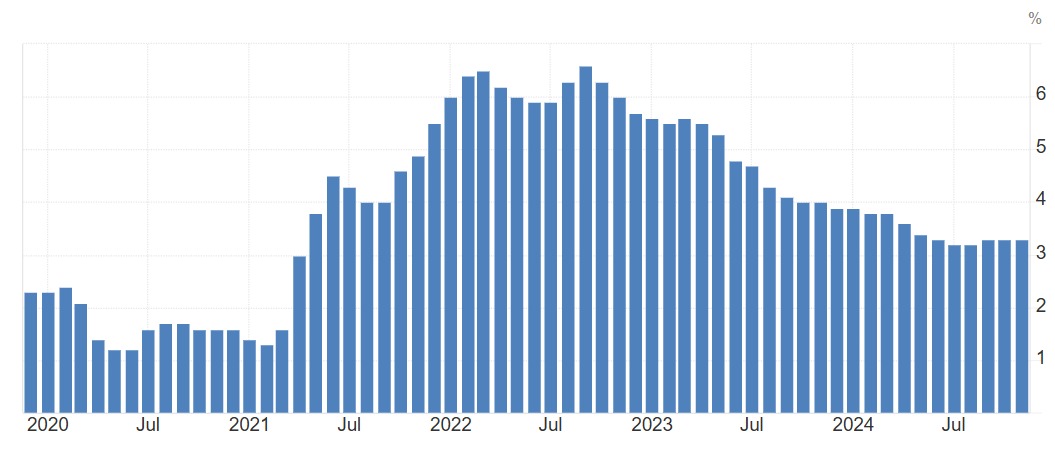

It peaked in 2022 and was declining…until recently:

Indeed, inflation is the biggest risk to stock and crypto markets nowadays. When inflation was trending lower, the central bank (Fed) was cutting interest rates in 2024.

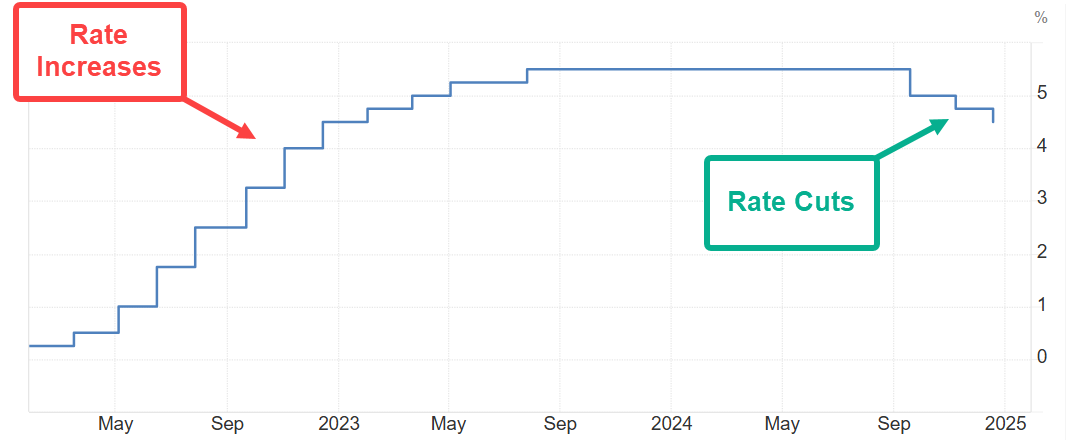

But now inflation is flat to slightly up, which caused the Fed to pause rate cuts in December and more data points are stirring up concerns about interest rate outlook for 2025:

Declining interest rates are positive for asset valuations (crypto, stocks, real estate, bonds) while rising interest rates are negative.

For now, the Fed is on a pause, neither raising nor cutting interest rates.

Is this a correction or are we entering a downtrend?

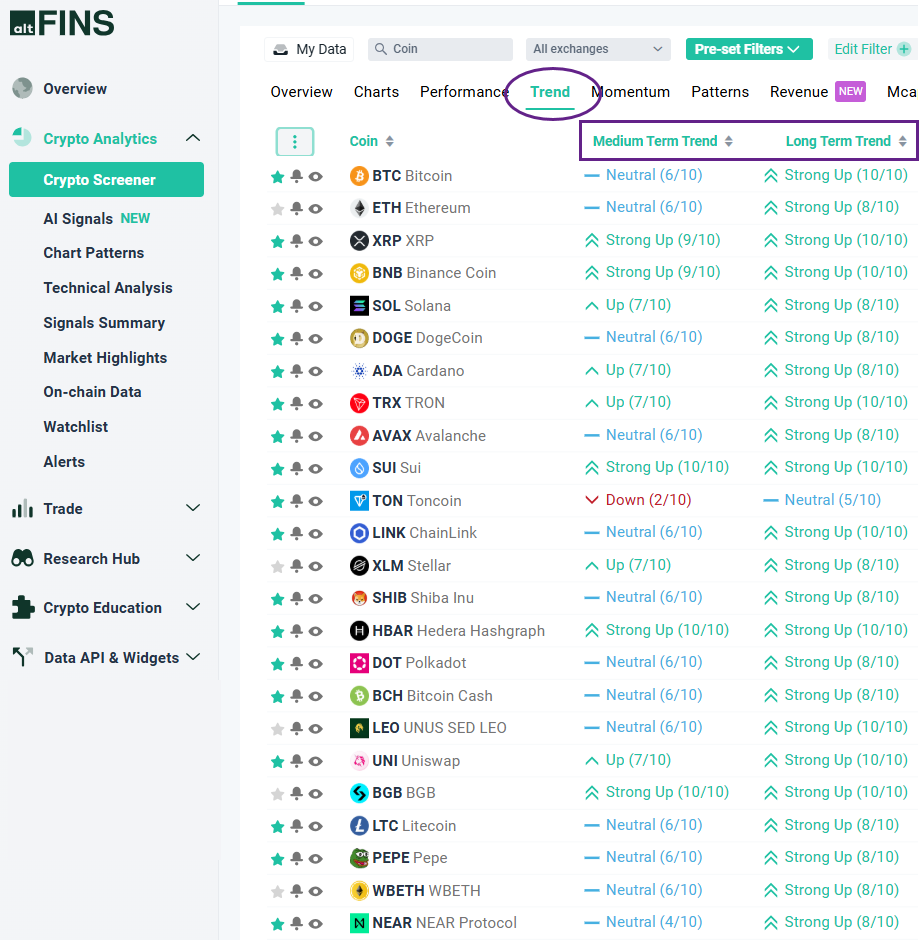

Based on altFINS trend ratings, BTC and most major altcoins are still in a Neutral or Uptrend:

However, there are plenty of assets, especially lower market cap assets, that have already flipped into Downtrend.

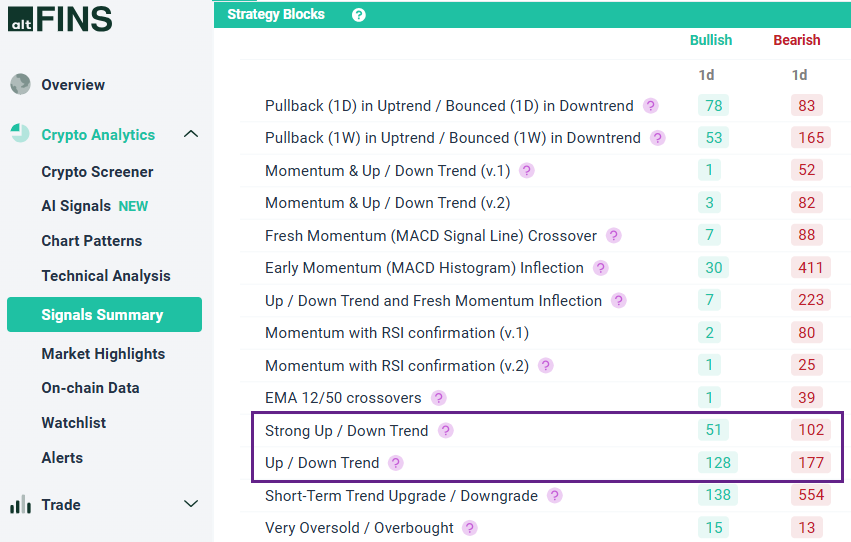

You can easily scan for assets in Uptrend or Downtrend on altFINS’ Screener and Signals Summary page:

Yet, trends are deteriorating.

Based on altFINS trend analysis (see image above), out of 3,000 assets tracked, 51 are in a Strong Uptrend and 128 in Uptrend, while 102 are in Strong Downtrend and 177 in Downtrend.

How to trade this market?

1. Be selective

2. Buy Dips in Uptrend near robust support (Lesson 3)

3. Hedge yourself with Short Selling assets in Downtrend (Lesson 10)

4. Manage your risk! (Lesson 9)

Above all, take this time to EDUCATE YOURSELF! Take the altFINS Trading Course and learn 7 trading strategies, plus risk management and Short Selling techniques.

Finding trade ideas using altFINS in any market is easy:

1. AI-driven Chart Patterns section: hundreds of trade signals every day accross 4 intervals (15 min, 1h, 4h, 1d).

2. Technical Analysis section: trade setups for 60+ major altcoins with Take Profit and Stop Loss levels.

3. Signals Summary section (see example below): quick links to 26 common chart patterns (wedges, channels, head and shoulders, etc.)

4. Crypto Screener section: use pre-set filters to quickly identify potential trading opportunities.

TIP: You can create an alert for Chart Patterns and receive them on iOS or Android mobile app! Don’t ever miss another trading opportunity. Here’s how.

0 Comments

Leave a comment