Coin Picks Portfolio

Dear Investors,

We are pleased to provide you with the latest update on the performance of our Coin Picks portfolio as of August 10th, 2024.

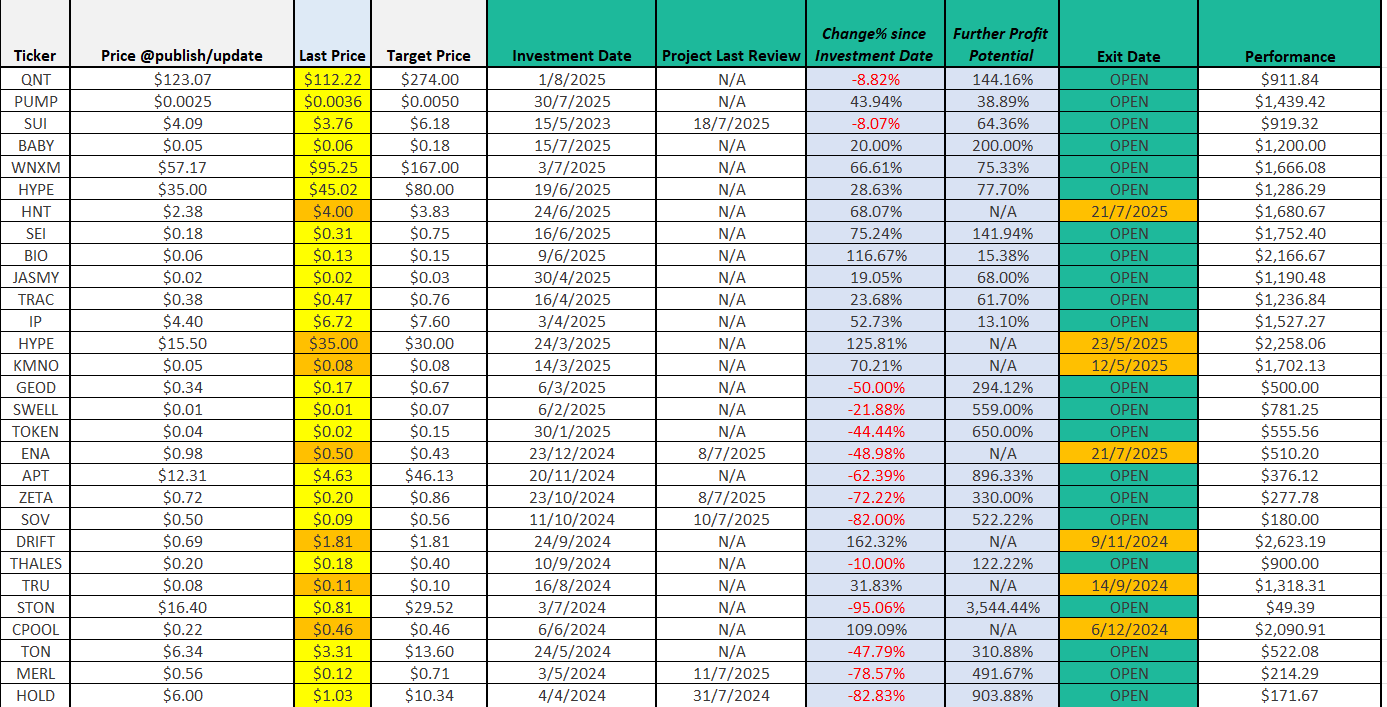

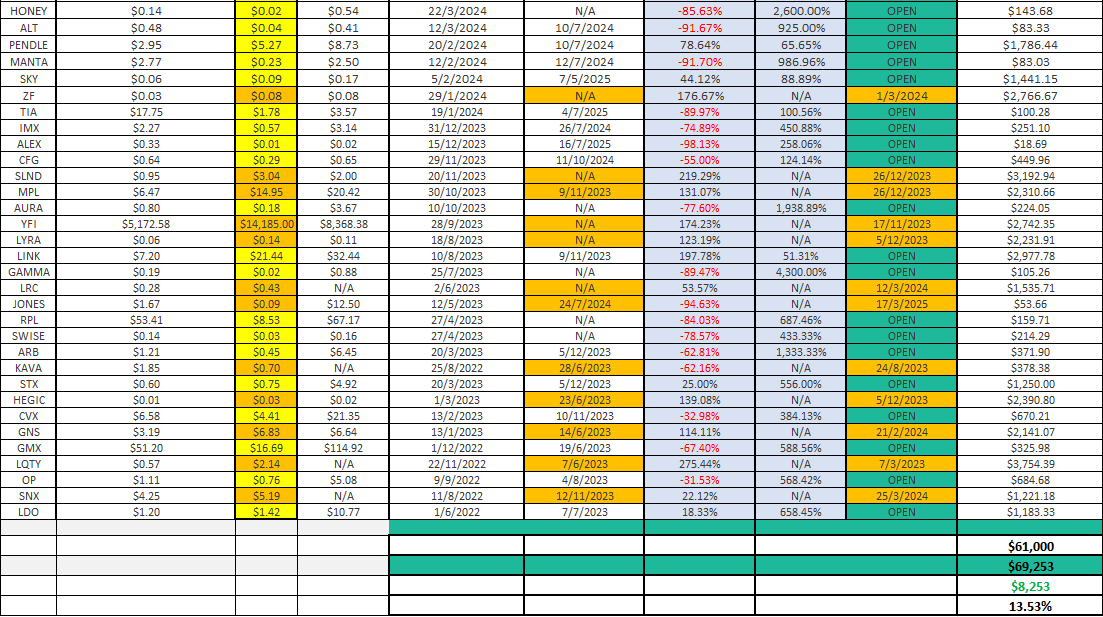

The calculation of the portfolio performance assumes hypothetical investments of $1000 in each project upon the initial research report release. We meticulously track and manage our positions, ensuring transparency and accountability in our investment approach.

Our portfolio has demonstrated robust performance, exhibiting a cumulative gain of 13.53% since inception. We pride ourselves on our commitment to delivering value to our investors and maintaining a high standard of professionalism in our investment practices.

Weekly Portfolio Updates

We recognize the importance of keeping our investors informed. To that end, we will provide regular updates on the portfolio’s performance on a weekly basis. This commitment aims to ensure transparency, facilitate informed decision-making, and foster a strong sense of trust between our team and our valued investors.

Explore all Coin Picks

Closed Positions

When a position is marked as “closed” in our portfolio, it signifies that we have executed the sale of the respective coin on the exact date indicated in the accompanying performance table. This transparent practice ensures accuracy in reporting and enables our investors to align their expectations with the actual outcomes.

Long-Term Profit Potential

In instances where a project may currently be in negative territory but still holds positive profit potential, rest assured that we maintain a long-term perspective. Our belief in the project’s future growth prospects informs our decision to retain these positions, anticipating favorable returns over an extended horizon.

Future Outlook

We remain optimistic about the ongoing and future performance of our Coin Picks portfolio. As we continue to navigate the dynamic cryptocurrency market, our team is committed to diligent research, strategic decision-making, and effective risk management to maximize returns for our investors.

Thank you for your trust and confidence in our investment expertise. We look forward to providing you with continued updates as we strive to achieve and surpass our investment objectives.

Summary Of Coin Picks Research Reports

- Institutional Decentralized Credit Marketplace

- Real World Assets and Liquidity, Liberated

- An Automated Interoperability Platform

- Meme Coins, Supercharged

- The fastest Layer-1 Protocol

- Innovative Bitcoin’s DeFi Solution

- The Synthetic Dollar Protocol built on Ethereum

- An emerging Layer-1 Ecosystem

- Young Layer-1 Multi-chain Solution

- Making Bitcoin Fun Again – innovative BTC Layer-2 solution

- Perpetual Trading Platform on zkSync Era

- Innovative Decentralized Physical Infrastructure (DePIN) Project

- Infrastructure Protocol for native and restaked rollups

- A raising star in tokenization and trading of crypto yields

- The third biggest scaling solution for Ethereum

- A well-established DeFi protocol on Ethereum

- The first Swap2Earn DeFi platform on zkSync Era ecosystem

- Innovative Modular Data Availability Network

- The Future of Gaming

- Decentralized Infrastructure for SME lending

- Autonomous lending and borrowing protocol on Solana

- Institutional Lending & Borrowing Protocol

- Balancer’s Liquidity Management Protocol

- An innovative asset management solution for digital assets

- Innovative Crypto Options Trading Protocol on Optimism and Arbitrum

- Connecting Blockchain World with the Real World

- Active Liquidity Management Solution with Market Making Strategies

- An innovative zk-Rollup Layer-2 Protocol

- Innovative Yield and Liquidity Protocol on Arbitrum

- Non-custodial Liquid Staking Provider on Ethereum

- Non-custodial Liquid Staking Provider on Ethereum

- The Biggest Layer-2 Scaling Solution for Ethereum

- Cross-Chain DeFi Lending Platform on Cosmos

- Credible and Innovative Scaling Solution for Bitcoin

- AMM Options Trading Protocol on Arbitrum

- Rewarding Yield Optimizer built on two well-known Stablecoin Platforms

- Perpetual Trading Platform on Polygon and Arbitrum

- Decentralized Derivatives Exchange on Arbitrum

- Promising Decentralized Lending & Borrowing Protocol

- An Optimistic Roll-up as Ethereum’s Layer-2 Solution

- The Derivatives Liquidity Protocol

- The Most Prominent Liquid Staking Service Provider

Understanding Fundamental Research:

Fundamental research involves a comprehensive analysis of various aspects of a crypto project to determine its intrinsic value and potential for long-term success. Unlike technical analysis, which primarily focuses on market trends and price movements, fundamental research delves into the project’s core details. These details include the team behind the project, its value proposition, tokenomics, user adoption, comparative valuation, growth potential, risks and challenges, and the overall transparency provided by the project.

Crypto Fundamental Research:

Project Details:

- Investigating the project’s whitepaper, roadmap, and technical specifications.

- Analyzing the project’s objectives, target market, and use cases.

Value Proposition:

- Assessing the unique features and innovations that set the project apart.

- Examining the project’s potential to solve real-world problems or disrupt existing industries.

Tokenomics:

- Scrutinizing the distribution model, token supply, and the project’s economic structure.

- Evaluating how the token is used within the ecosystem and its potential for value appreciation.

User Adoption:

- Examining the current user base and community engagement.

- Assessing the project’s strategies for attracting and retaining users.

Comparative Valuation:

- Comparing the project with similar ones in the market.

- Evaluating key metrics such as market capitalization, token price, and trading volume.

Growth Potential:

- Analyzing the scalability of the project and its potential for mass adoption.

- Investigating partnerships, collaborations, and expansion plans.

Risks & Challenges:

- Identifying potential risks, regulatory challenges, and technological vulnerabilities.

- Assessing the project’s resilience and risk mitigation strategies.

Team, Investors & Audit:

- Evaluating the expertise and track record of the project’s development team.

- Investigating prominent investors and partnerships.

- Verifying the project’s security through audits and code reviews.

Explore all Coin Picks

FAQ

0 Comments

Leave a comment