Week and Month in review: Bitcoin's gains fail to lift altcoins

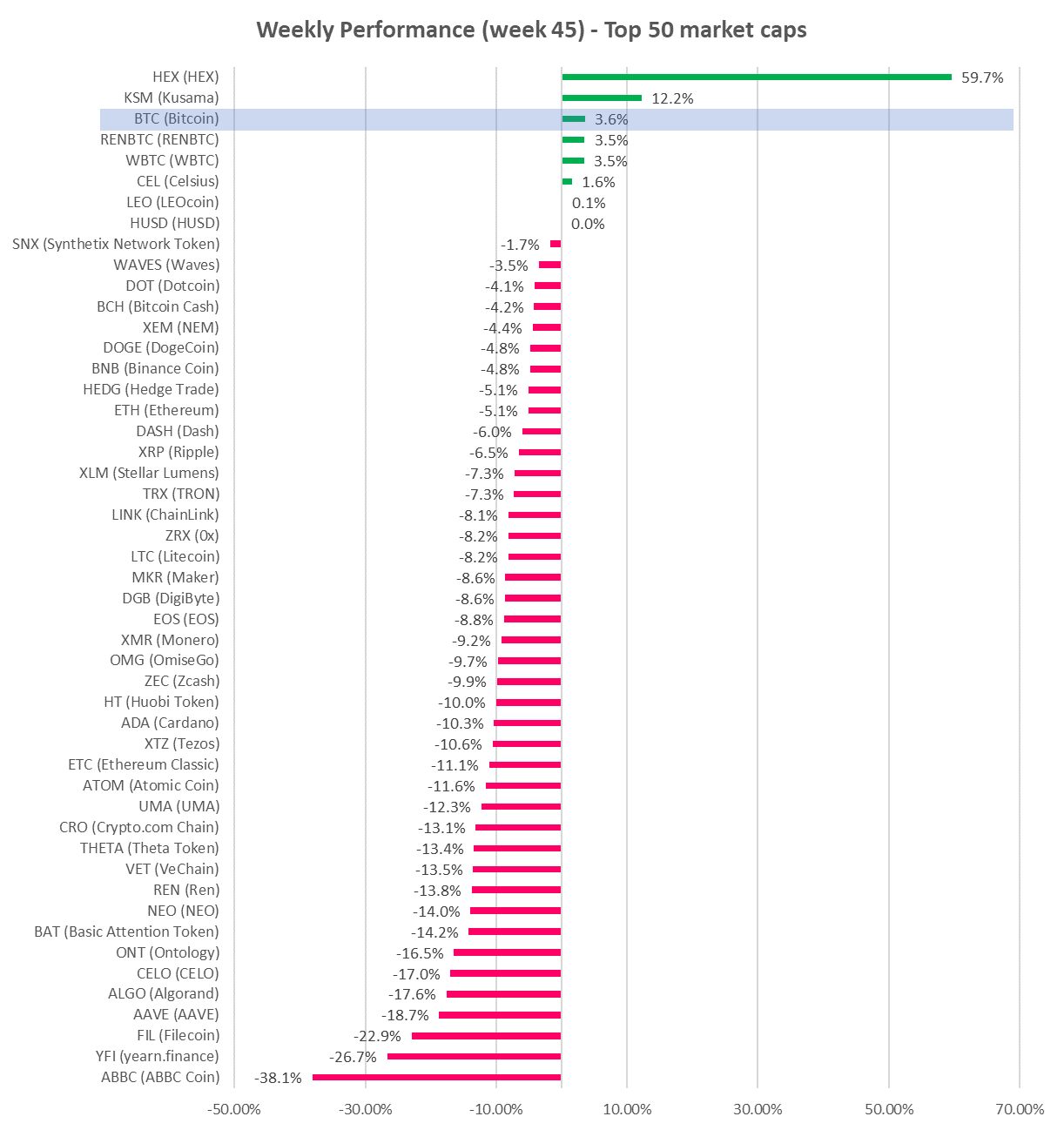

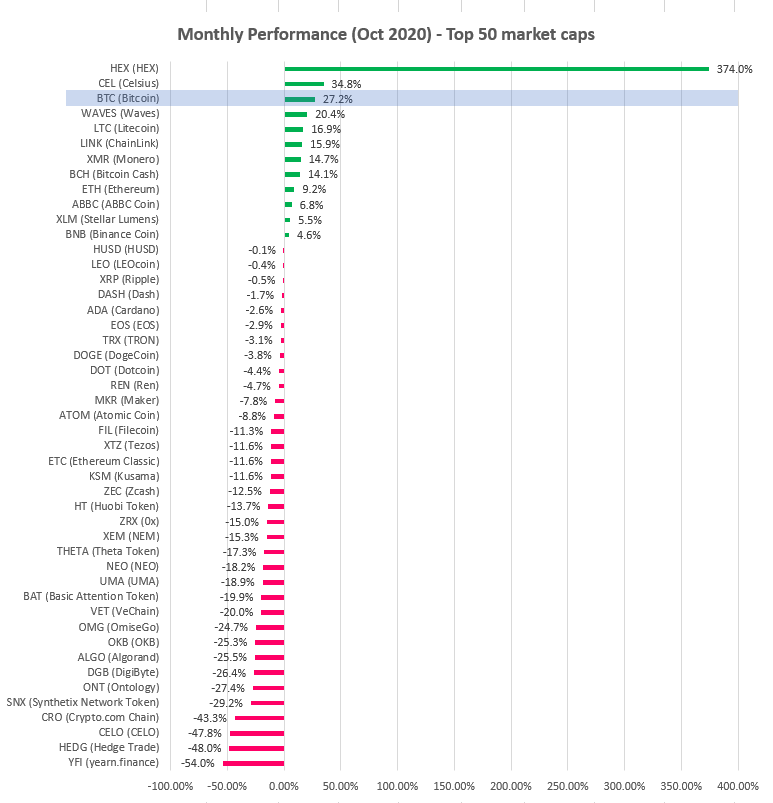

Last week and month were great for Bitcoin. Altcoins? Not so much.

In October, Bitcoin benefited from:

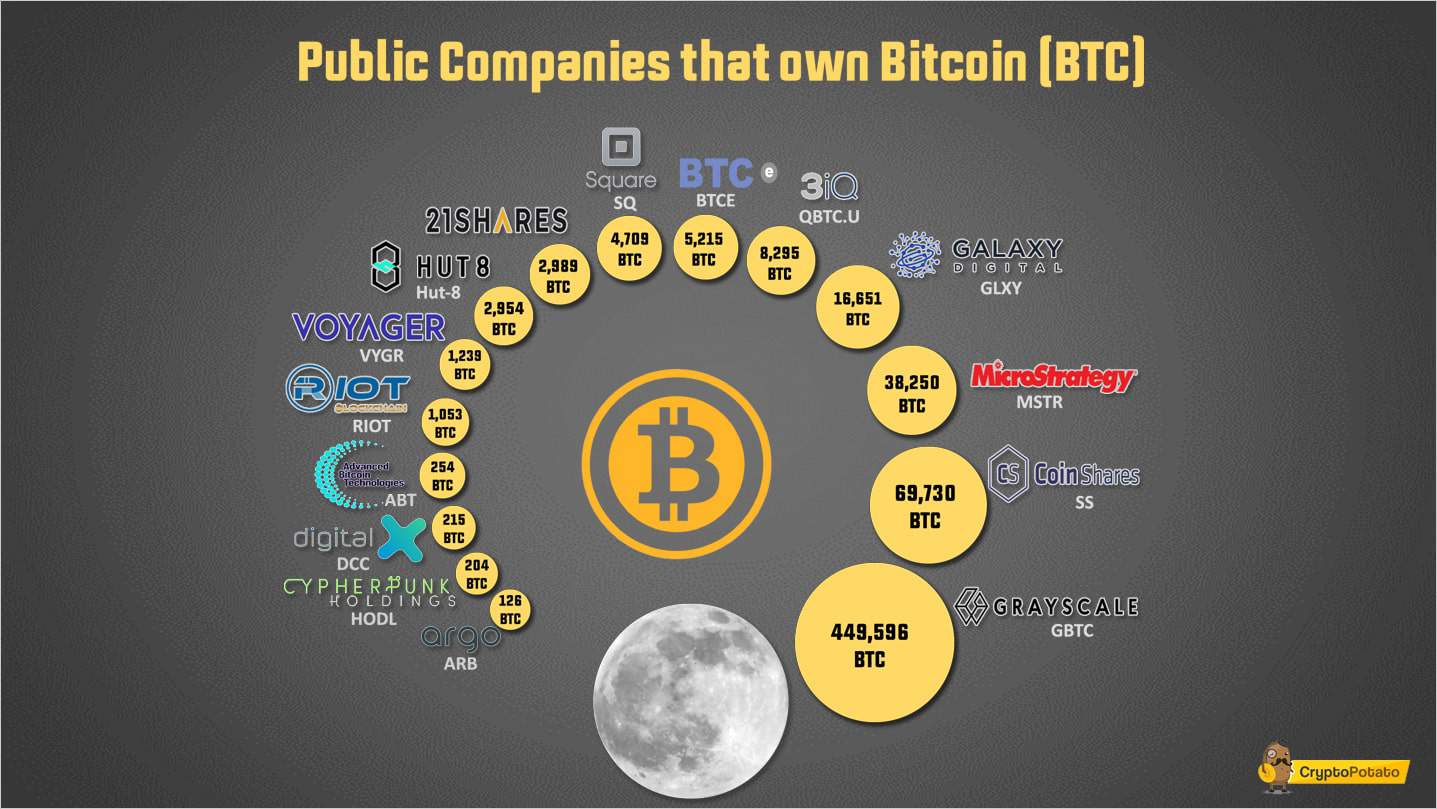

- News of corporations allocating portions of their cash to Bitcoin. MicroStrategy and Square have picked up over $425 million and $50 million respectively.

- Institutional investors favoring Bitcoin as an inflation hedge. Hedge fund managers like billionaire Paul Tudor Jones have turned to Bitcoin to protect against inflation.

- Mainstream adoption of Bitcoin as a payment and investment vehicle. PayPal’s announcement to enable its 350M users to pay with and buy/sell four cryptocurrencies is a huge step forward for broad public adoption.

If you’d like to receive future blog updates in your inbox, please subscribe to our newsletter.

Altcoins performed poorly in part due to continued fallout from DeFi bubble that peaked in August / early September. While value locked in DeFi protocols is still growing, the prices of their coins have been declining. Yearn.Finance (YFI) is a poster child for DeFi’s rise and bust, as the coin went from $0 (yes zero) in July to $40K on Sept 12 and back to $10K today.

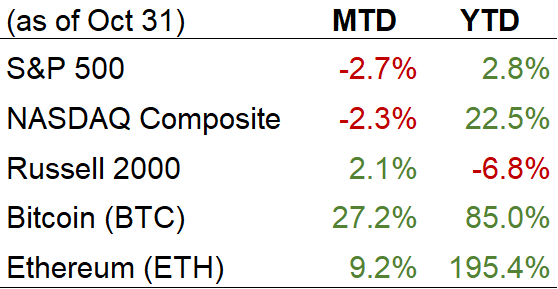

Still, year-to-date (YTD) and month-to-date (MTD) performance for Bitcoin and most altcoins compare quite favorably to major stock market indexes:

Bitcoin (BTC) analysis. Following a break through $12K and $13K resistance zones, the next meaningful resistance level for Bitcoin can be derived from Fibonacci retracements theory, based on which, we’ve reached a 61.8% retracement from the 2017’s all-time high and this level also coincides with high from June 2019. Also, we note that RSI is quite overbought, but if this resistance is taken out, then path to $16,300 is clear.

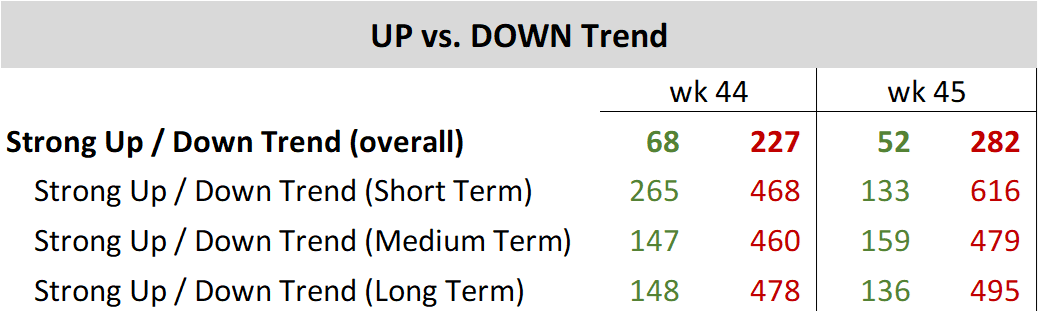

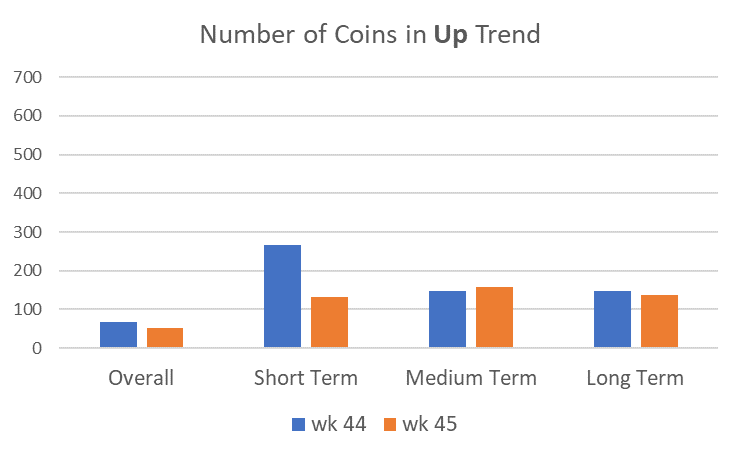

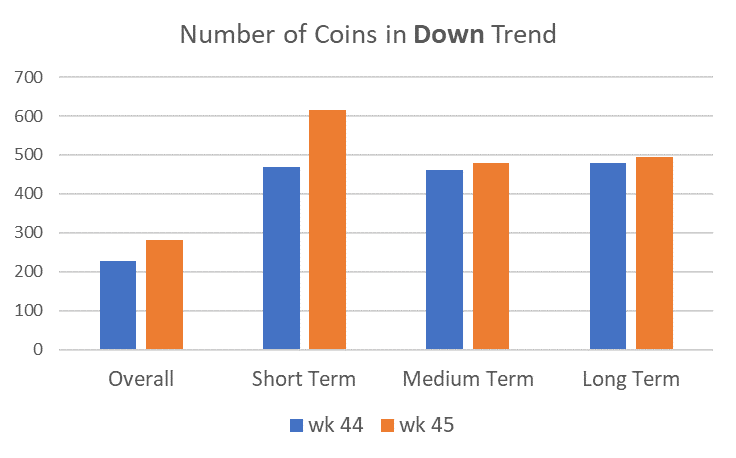

More assets (5:1) remain in a downtrend than uptrend, and that ratio got worse last week.

You can monitor these trends on the Signals Summary page, which also contains shortcuts to strategy screeners.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.