Cryptocurrency Trading Course

There are many signal providers out there, copy trading solutions, bots, algos, telegram VIP channels…. All of these sell dreams of making you a quick buck. But ideally, you should learn the concepts of technical analysis and trading in Cryptocurrency Trading Course from ground up on your own, at minimum to be more knowledgeable, and potentially to be able to invest and trade on your own, and not depend on anyone else!!

Of course there are many trading strategies and it can be extremely overwhelming and confusing for beginners.

So we designed a program for beginner traders to teach the basics concepts of technical analysis and how to fully leverage our powerful platform to find profitable trading ideas and strategies.

And that’s what altFINS platform really is. It’s a tool to find potentially profitable trading ideas.

altFINS Cryptocurrency Trading Course consists of series of 10 webinars that teach our users how to take full advantage of the platform’s capabilities.

Education webinars are also part of all plans (Basic, Essential, Premium). Basic plan starts from $20 a month. Or you can Hodl AFINS tokens to get access to altFINS Education. Learn more on our pricing page!

The webinar series are led by none other than altFINS’ CEO and Founder, Richard Fetyko (LinkedIn). You may know him from altFINS youtube channel.

Mr. Fetyko spent 14 years on Wall Street as an equity research analyst at investment banks like Janney Montgomery Scott, covering Internet and Tech sectors, and then 6 years as a portfolio manager at a family fund Twin Capital. During his Wall Street career, Mr. Fetyko was ranked among top analysts.

Cryptocurrency trading course full of practical examples!

Instead of boring theory, we focus on practical use with live trade examples.

Sure, we cover some theory on what’s an RSI, MACD, SMA/EMA and such. But in our Cryptocurrency Trading Course most of time we spend applying these concepts and altFINS’ platform to best use.

We create custom screens to find altcoins in uptrend, EMA crossovers, momentum swings, oversold or overbought, pullbacks to support levels, breakouts through resistance, chart patterns and more.

After each webinar, you’ll be able to replicate the steps and find attractive risk/reward trades on your own.

If you want to learn and are willing to find time and invest into yourself, then we cordially invite you to come along.

Learn with altFINS’s Trading Cryptocurrency Course: How to trade Cryptocurrencies!

Here’s an outline of the altFINS Cryptocurrency Trading Course:

- Foundation of TA.

- Strategy: Trading moving average crossovers.

- Strategy: Pullback in Up (Down) Trend.

- Strategy: Momentum & Uptrend.

- Strategy: Oversold at Support (Overbought at Resistance).

- Strategy: Trading ranges.

- Strategy: Trading key levels (breakouts and approaches).

- Strategy: Trading chart patterns.

- Risk management.

- Margin account trading & Short selling.

Why to choose altFINS for trading cryptocurrencies?

- altFINS is a tool for active crypto traders and investors (HODLers).

- Makes you more efficient by enabling you to monitor your coin positions and trade across multiple exchanges.

- Find trading ideas and create your own trading signals.

- Learn trading using technical analysis.

- Saves you time with scanning the crypto exchanges for trading ideas.

How do we do it?

altFINS platform calculates over 120 different analytics (e.g. RSI, MACD, SMA, EMA), across 5 time intervals, thousands of coins and trading pairs. In order to do that, the system ingests about 300 million data records and makes over 1 billion calculations per day. This process is managed by a proprietary data management system developed specifically for the altFINS platform. It offers altFINS users the same advantage those more sophisticated players have at a fraction of the cost to find better and informed crypto trading ideas.

Moreover, the platform automatically detects and flags certain trading patterns (wedges, triangles, head and shoulders, etc.).

Using altFINS, you can find crypto assets that:

- Are in a strong uptrend or downtrend.

- Are oversold or overbought.

- Are developing or breaking out of their technical price patterns (wedges, triangles, head and shoulders, support and resistance).

- Have experienced SMA or EMA crossovers (bullish or bearish).

Is the Cryptocurrency Trading Course for you?

This Trading Course is perfect for you if:

- You are a novice or beginner trader, eager to get started with crypto trading.

- You are looking to learn and apply basic concepts of technical analysis.

- You are interested in leveraging altFINS’ platform to find attractive risk/reward trades.

- Time is critical – you have an extremely busy schedule.

This Course IS NOT FOR YOU if:

- You are looking for day trading, arbitrage, or scalping techniques.

- You are looking for a “get rich quick” scheme.

- You are not willing to invest time and money into education.

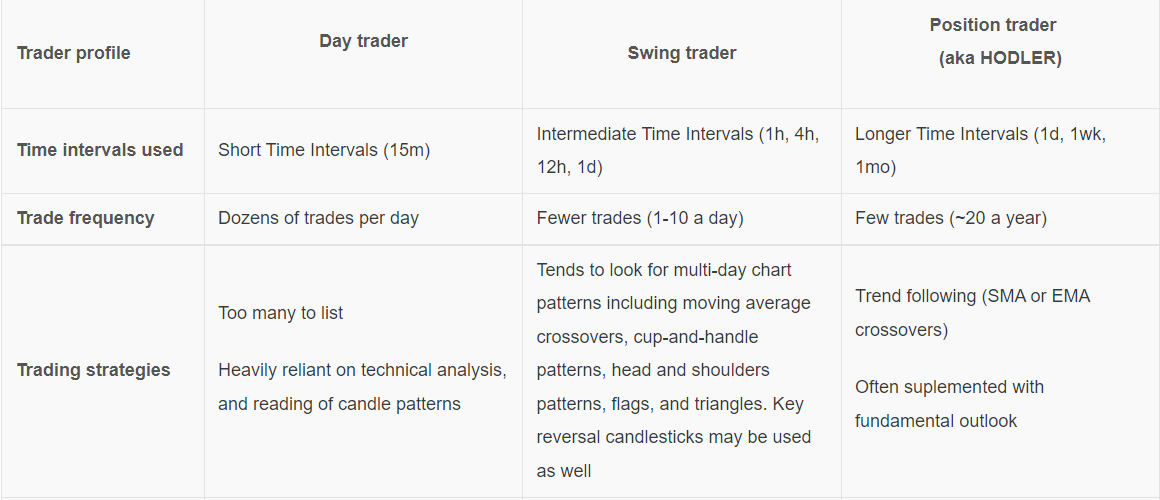

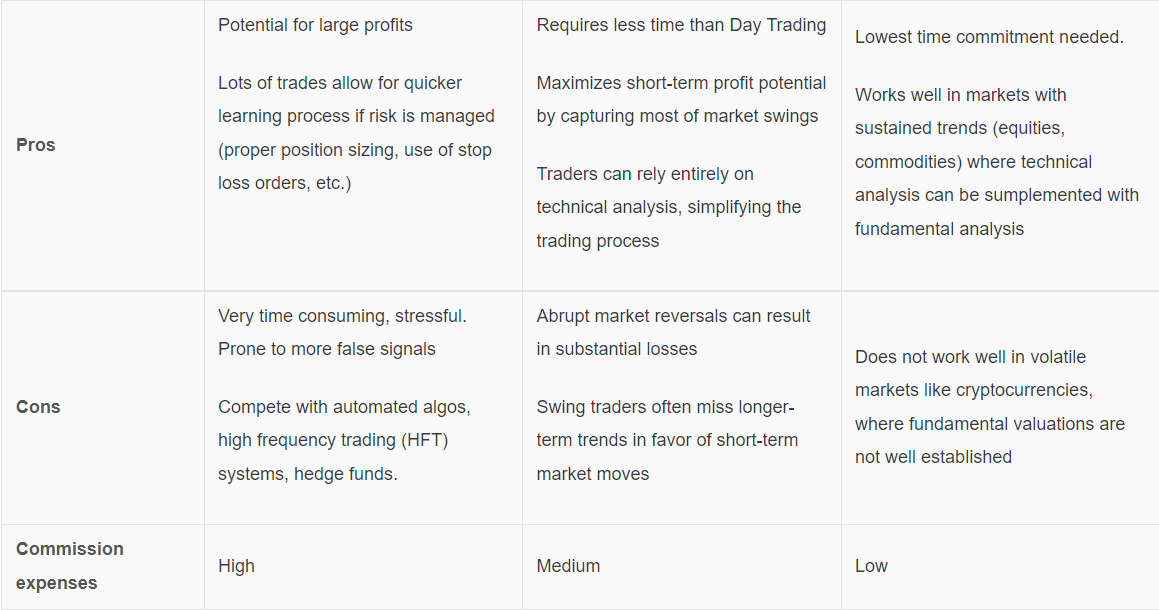

Do you know what kind of trader are you?

Lesson 1: Foundation of TA

What is Technical analysis?

In the first lesson, we go trough Charting: Line vs. Candlestick and Trends. We will focus on questions:

- How to identifies up/ down trend?

- How to screen coins based on trends?

- How to use Moving Average to find trends?

- What are Higher Heights, Higher Lows?

- How to choose the right time interval?

Watch Excerpt from lesson 1 in the video: Line v Candlestick charts.

Download the notes from Lesson 1.

Lesson 2 (strategy): Trading MA crossovers

This is simple strategy. Find a trend and ride it for big gains. Moving averages are used to spot trends.

In the second webinar, Richard speaks about concepts of such as Trend Trading, Moving averages (EMA vs SMA), MA crossovers, Golden/ death cross, MA slope and MA Ribbon.

In Practical Implementation we:

- Scan for MA crossovers.

- Using MA slopes.

- Scan for MA Ribbons.

- Scan using altFINS’ trend ratings.

- Creating alerts for MA crossovers

- Using Signals Summary page.

Trading Rules:

- Buy when shorter SMA (or EMA) crosses above longer SMA (or EMA).

- Sell when shorter SMA ( or EMA) crosses below longer SMA (or EMA).

Watch Excerpt from lesson 2 in the video: Trading MA Crossovers.

Download the notes from Lesson 2.

Lesson 3 (strategy): Pullback in an UpTrend (“buy dip”)

Pullbacks can often provide opportunities to jump on an established trend. There are times when price consolidates, pulls back, and then resumes a trend. These corrections are opportunities to join a trend.

TA concepts covered: Trend trading, Support / Resistance, Polarity, Corrections, Setting Stop-Loss levels.

Practical implementation:

- Scan for coins in Up/Down trend with a pullback.

- Identifying Support / Resistance.

- Creating Price and Alerts.

- Using Signals Summary page.

Trading Rules:

- Find altcoins in an Uptrend but have had a 5%+ pullback (a correction, consolidation).

- Identify a Support Zone. This is often prior Resistance Zone or prior high point.

- Selling volume dries up during the pullback.

- Buy if the price is near or touches a Support Zone.

Watch Excerpt from lesson 3 in the video: Pullback in an UpTrend (“buy dip”).

Download the notes from Lesson 3.

Lesson 4 (strategy): Momentum & Uptrend

This trading strategy looks for altcoins in an uptrend and identifies opportunistic entry and exit points using momentum indicators (MACD, RSI).

TA concepts covered: Trend trading, MACD Signal Crossovers, MACD Histogram inflection, RSI.

Practical implementation:

- Scan for coins in Uptrend and a bullish momentum swing.

- Creating MACD crossover Alerts.

- Using Signals Summary page.

Trading Rules:

- Find altcoins in an Uptrend.

- Buy when MACD line crossed above MACD Signal Line.

- Sell when MACD line crossed below MACD Signal Line.

Watch Excerpt from lesson 4 in the video: MACD Histogram.

Download the notes from Lesson 4.

Lesson 5 (strategy): Oversold at Support, Overbought at Resistance

This trading strategy looks for coins that are very oversold (RSI), approaching Support and with potential momentum (MACD) inflection.

And vice versa for very coins that are very overbought, approaching resistance and momentum inflection.

TA concepts covered: MACD Histogram inflection, RSI (Overbought, Oversold), Support / Resistance.

Practical implementation:

- Scan for coins that are oversold (RSI), approaching Support and with potential momentum (MACD) inflection.

- Creating Alerts for Very Oversold / Overbought coins using RSI.

- Using Signals Summary page.

Trading rules:

- Buy when RSI dips under 25 and MACD Histogram inflects bullish or price near support.

- Sell near the next Resistance or when MACD Histogram inflects bearish.

Watch Excerpt from lesson 5 in the video: RSI (Oversold at Support, Overbought at Resistance)

Download the notes from Lesson 5.

Lesson 6 (strategy): Trading Ranges

Range-bound trading is a trading strategy that seeks to identify and capitalize on coins trading in price channels.

TA concepts covered: Trading range, Support / Resistance, Oversold / Overbought signals using RSI, STOCH, CCI indicators.

Practical implementation:

- Scan for coins with flat slopes of moving averages.

- Using Signals Summary page.

Trading rules:

- Find coins in an Uptrend on Long-term basis, but sideways (Neutral) trend on Medium- or Short-term basis.

- Identify Support and Resistance Zones.

- Buy Support, Sell Resistance.

- More advanced version: Buy Support when RSI is Oversold (<40) and Sell Resistance when RSI is Overbought (>60).

Watch Excerpt from lesson 6 in the video: Trading ranges.

Download the notes 6 from Lesson 6.

Lesson 7 (strategy): Trading Key Levels

Key level approach and breakouts.

Key levels (horizontal support and resistance) are pillars of technical analysis because these are areas where a lot of trading action happens.

TA concepts covered: Support / Resistance, Key level approach, Key level breakout, Breakout failures.

Practical implementation:

- Scan for coins with key level approach or breakout, and in sync with trend direction.

- Using Signals Summary page.

Trading rules:

- Find coins with key level approach or breakout.

- Trade with trend.

Watch Excerpt from lesson 7 in the video: Trading Key Levels.

Download the notes from Lesson 7.

Lesson 8 (strategy): Trading Chart Patterns

Price patterns appear when traders are buying and selling at certain levels, and therefore, price oscillates between these levels, creating chart patterns. When price finally does break out of the price pattern, it can represent a significant change in sentiment.

TA concepts covered: Chart pattern types, Emerging vs. completed (breakout) patterns, Patterns with highest win rates, Chart pattern cheat sheet.

Practical implementation:

- Scan chart patterns by type, trade direction, pattern stage and profit potential.

- In sync with trend direction.

- Using Signals Summary page.

Trading rules:

- Find coins with Ascending triangles, Inverse Head and Shoulders, Channel Up, Rising Wedge…

- Trade with trend or market neutral.

- Many small positions.

Watch Excerpt from lesson 8 in the video: Trading Chart Patterns.

Download the notes from Lesson 8.

Lesson 9: Basic risk management

- Proper position sizing.

- Don’t risk more than 2% of the portfolio equity.

- How to calculate an appropriate position size.

- User of stop loss orders.

- Where to place stop loss orders.

- Risk-reward-ratio (RRR).

- How to determine the downside (risk) and upside (reward) of a trade.

Read about: Trading Risk Management.

Watch Excerpt from lesson 9 in the video: Risk Management.

Download the notes from Lesson 9.

Lesson 10: Margin account trading + Short Selling

- What’s a margin account.

- Cross vs. Isolated margin (using Binance).

- How to open and close out a margin position.

- What’s Short Selling and when to use it.

- How to place a Short Sell position.

- Risks and benefits of margin trading and Short Selling.

Watch Excerpt from lesson 10 in the video: Short Selling.

Download the notes from Lesson 10.

Become a crypto trader with altFINS. Subscribe for Cryptocurrency Trading Course now!