Cryptocurrency Price Analysis - week 14 and YTD (2021)

Cryptocurrency Price Analysis – week 14 and YTD, 2021

Last week, altcoins continued their rally. We’re seeing many bullish formations and breakouts. Check our curated charts for examples updated daily (click on curated charts tab).

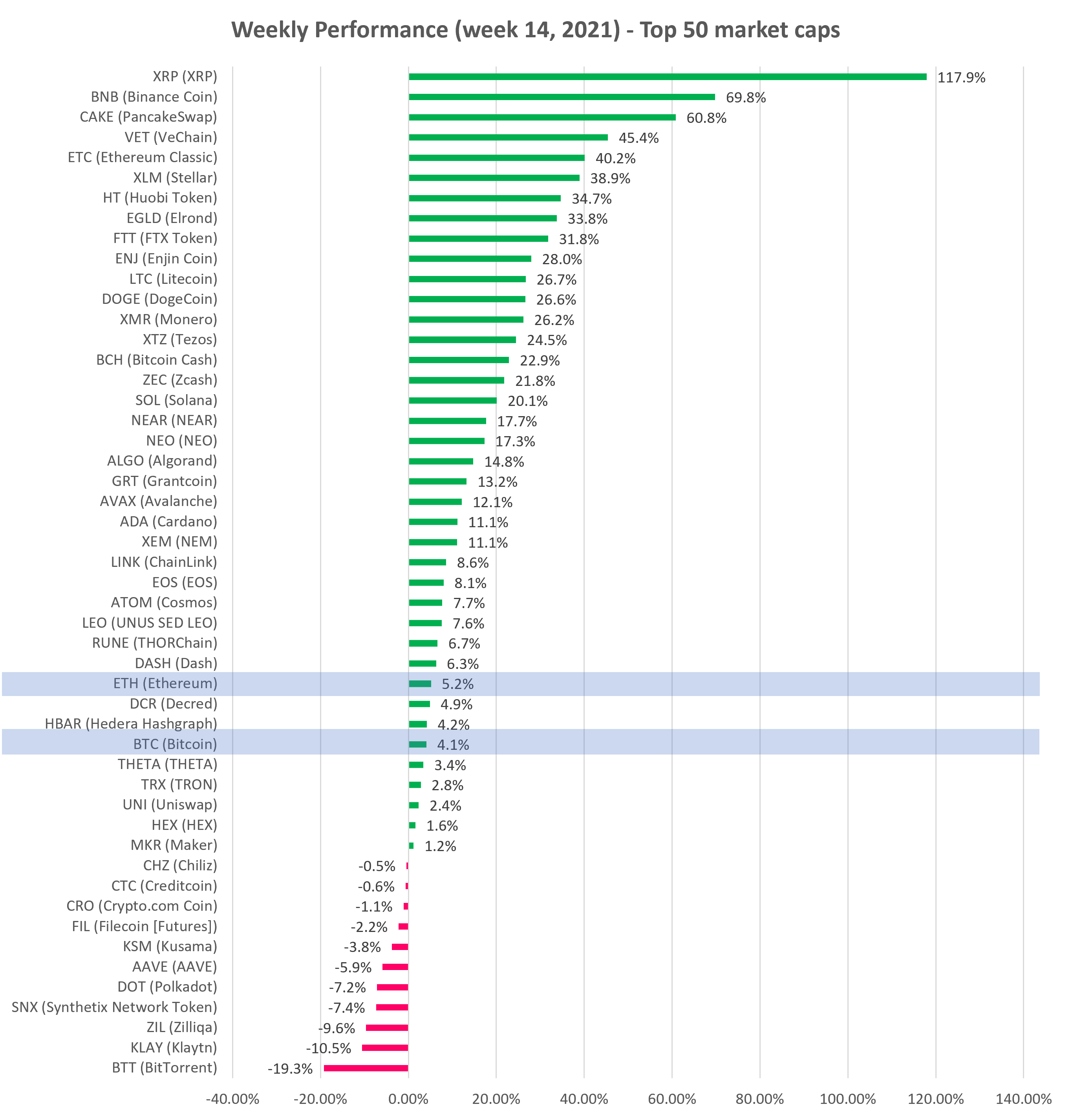

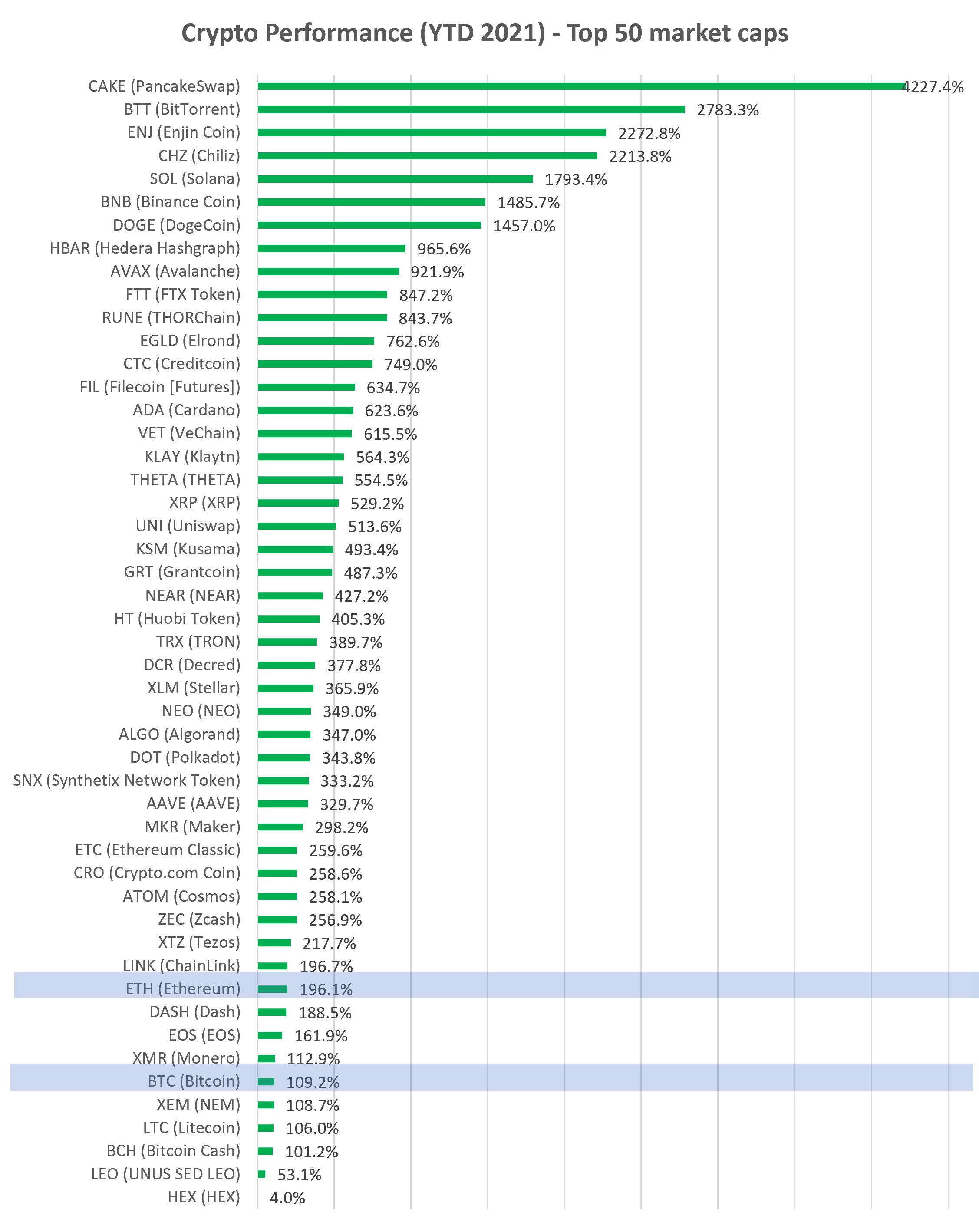

BTC and ETH were up for the week, and altcoins posted overwhelmingly positive performance among the top 50 coins by market cap (see charts below). Among the winners were CEX coins like Binance (BNB), Huobi (HT), FTX (FTT) and Bitfinex (LEO), but also, consistently a DEX: PancakeSwap (CAKE). The biggest gainer was Ripple (XRP), following their acquisition of a payments platform Tranglo and on perception that Ripple management is getting the upper hand in the SEC investigation.

Bitcoin (BTC) and Ethereum (ETH) were up 4.1% and 5.2% (vs prior week’s 2.8% and 19.9%).

After getting rejected at $60K resistance area three times, Bitcoin now appears to have digested the supply at this important resistance level and is ready to break out of the Ascending Triangle:

Source: altFINS.com

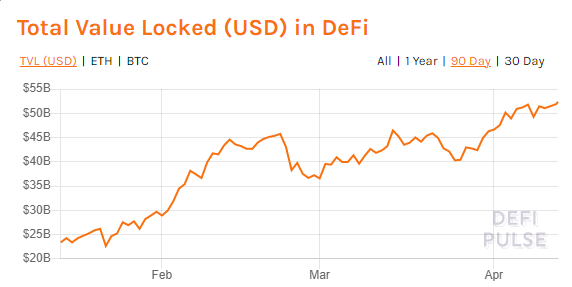

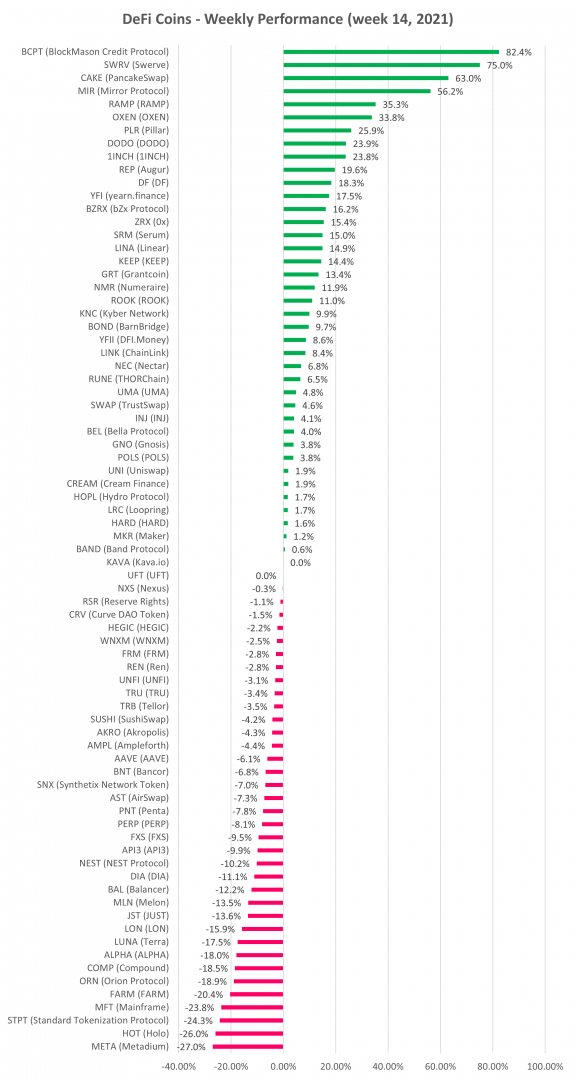

Decentralized Finance (DeFi) – Total Value Locked (TVL) increased last week to $52.3B, up 4% w/w and 233% YTD.

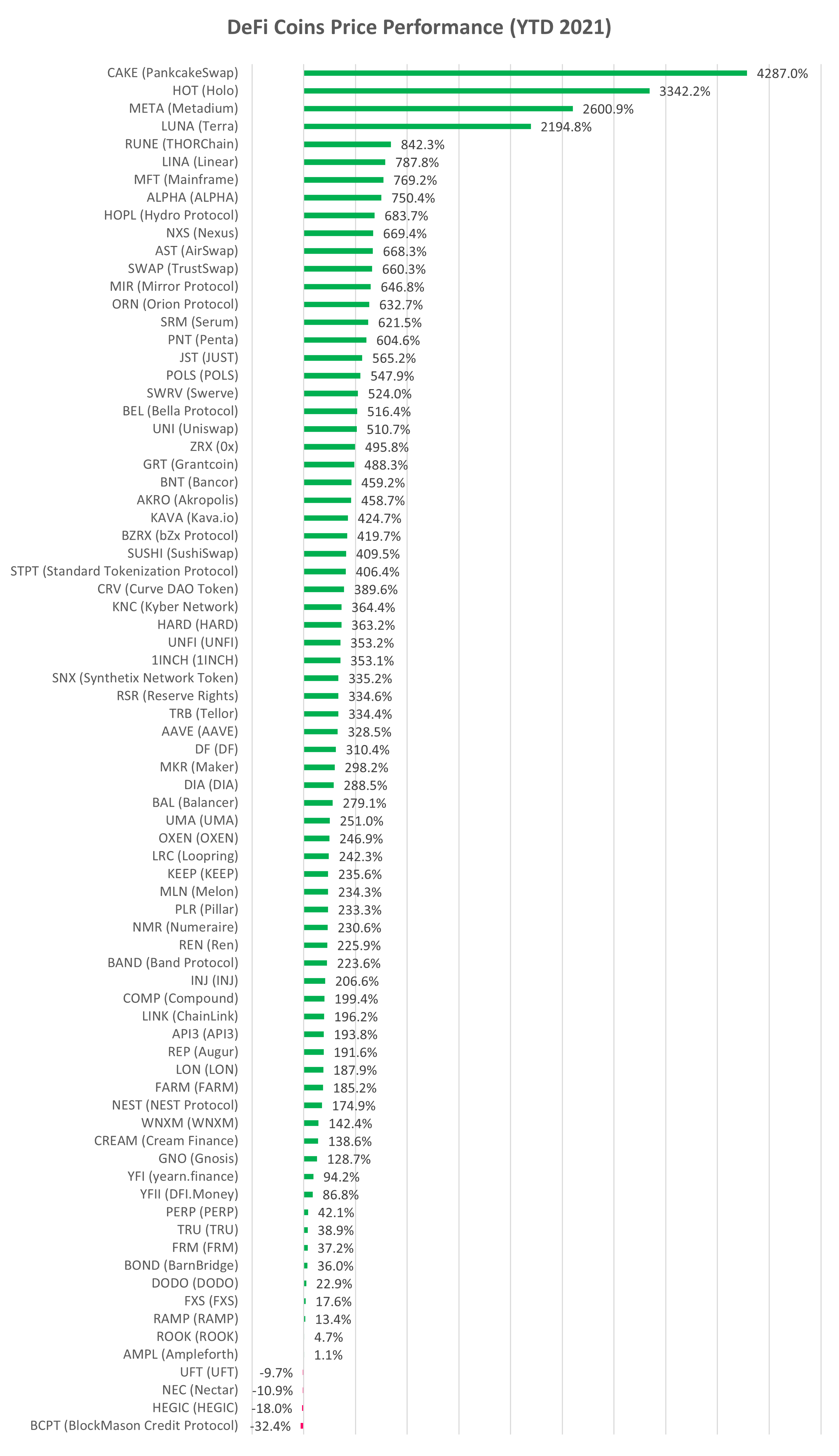

DeFi cryptocurrency prices were also among solid gainers as total DeFi category market cap increased 6% last week and is up 416% YTD (i.e. ~ 5.0x).

Source: DeFiPulse

Source: altFINS.com

Check our unique automated chart pattern recognition for fresh trading ideas. Also, during market corrections, it’s always good to revisit coins in an Uptrend but with a pullback. Our Signals Summary has this and other pre-defined filters ready for action.

Subscribe to our newsletter to receive future blog updates in your inbox and make sure you add altfins.com to your email whitelist.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.